It’s not just newspapers struggling to find their way in the digital era. Many content companies — broadcasting, film, music, publishing, and gaming — are grappling with the same business model uncertainty.

In a recent survey (pdf), the consulting firm Accenture asked 102 content-industry leaders to pick the biggest hurdle they face. Overwhelmingly, executives pointed to the hunt for a viable business model. And since they’ve asked the same question (sort of — see below) for three years, we can look at how execs’ thoughts have shifted over time.

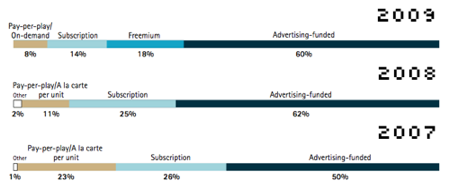

First, the data shows a clear decline in what Accenture calls the “pay-for-play” concept — something like what we in the news context would term micropayments or “the iTunes model.” In 2007, 23 percent of respondents were banking on micropayments as the next top business model. In 2008, that number dropped to 11 percent. In 2009, it fell to just 8 percent.

But beyond that, the changing nature of the options Accenture gave respondents muddies the waters a bit. In 2009, the survey included two new options: “freemium” (some content remains free, users can pay for extra content) and “hybrid” (a combination of different models, like ads plus a subscription). One could easily argue that freemium is a type of hybrid, and for the chart above, Accenture chose to combine the hybrid responses with advertising ones. (The 60 percent you see above is actually 39 percent advertising, 21 percent hybrid.)

I spoke with David Wolf from Accenture’s media division about what we should take away from the findings. He said that the clear takeaway here is that “hybrid” models are the next big thing. “The only thing we can discern as we get through our research and look at it is there is no business model clearly emerging as ‘the one,'” Wolf explained.

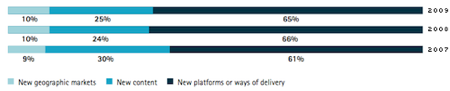

Going hand-in-hand with a hybrid business model is an aggressive transition to a multi-platform delivery strategy. “What we conclude [from the survey] is that the platforms and the growth need to be viewed as integrated,” Wolf explained. “How do we create offerings that span the screens?” About 65 percent of respondents said new platforms or method of delivery is where they’ll find business growth next year, compared to 25 percent by creating new content, and 10 percent by expanding to new geographic areas. Those are all roughly similar to previous years.

Another trend to watch is the media industry moving toward a more personalized use of data. Rather than thinking about audience in broad terms, Wolf predicts media companies will get better at tailoring to individuals the way a hotel chain attracts customers with loyalty programs. Where companies once went after a demographic group like tweens, Wolf mentioned, “we’re changing that mindset” to something much more individualized.