The Globe and Mail often gets called Canada’s New York Times, because of the paper’s size and reach on the northern side of the 49th parallel. Now the paper is hoping to emulate the Times’ success in getting readers to pay for online access to news.

The Globe and Mail often gets called Canada’s New York Times, because of the paper’s size and reach on the northern side of the 49th parallel. Now the paper is hoping to emulate the Times’ success in getting readers to pay for online access to news.

On Monday, the paper unveiled Globe Unlimited, a digital subscription plan that follows what should be a familiar model now in newspapers: A metered allowance for free stories (10), a monthly all-digital subscription, free access for print subscribers, and a doggie-door for people coming in through social media.

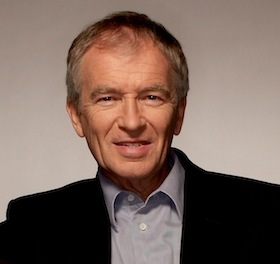

When I spoke with Phillip Crawley, publisher of The Globe and Mail, he characterized most paywalls as “a fairly desperate act” for newspapers that don’t evaluate what content or utility they offer readers. National and business coverage is the cornerstone of The Globe and Mail’s work, Crawley said, and with Globe Unlimited they can deliver the news in more effective, personalized ways.

In our conversation Monday, Crawley also spoke about the need for media companies to gather better data on their users in order to provide better service and improve the quality of advertising. Below is a lightly edited transcript of the conversation.

We have done some research over the last year particularly — this has been under development since summer of last year, — and we conducted quite a lot of reader research. We have a pretty well identified reader group. We know where to go to get some honest opinions from our audience, and we were asking questions in terms of willingness to pay — what it was they might be willing to pay for, what their price sensitivity was, whether they were digital-only users or whether they were people who were print subscribers who might also be interested in a digital delivery system.

A number of large players are currently either about to, or just decided to, go down this route. And I think the success that The New York Times is claiming for its paywall has influenced a lot of people, in the sense they keep coming up with results on a quarterly basis, which indicates some sustained growth. And that’s helping their share price, for sure.

Over the last couple of years, the increase in the consumption of our content on smartphones, on tablets, has been enormous. We’ve just seen a really big uplift in that. It’s less clear, in some cases, how that is going to convert into serious dollars.

We feel we’re bringing together some high quality content from a variety of sources so that people who are interested in interpreting what’s going on in the market, getting background, more than just the headlines, will be able to find a lot of this in one place. They will be able to organize this content. We’ve got a very good new tool called Dashboard, which will allow you to personalize your screen whether its a desktop or a laptop, a BlackBerry or a smartphone, or an iPad.

So it’s like a newspaper. People pay for the utility of having the newspaper delivered to their doorstep. They’re prepared to pay for that service. And we believe people will also pay if you make the digital content easily accessible on whatever screen they happen to be using at one time, because a lot of our customers have multiple screens, obviously.

Digital ad revenue has been an important growth area for us over the last 10 years, but that’s changing very rapidly too. In the last couple of years, the advent of ad networks, of real-time bidding, the way a lot of web inventory is being commoditized — effectively the line rates are being driven down. It has changed the way we look at digital advertising. We had probably 10 years where digital advertising just grew and grew on the back of banner ads and so forth. That’s no longer the case. We need different solutions.

The Globe is actually just launching — we were down in New York a week or so ago — in partnership with The Wall Street Journal, Forbes, and Thomson Reuters, we’re launching an ad network of our own to deal specifically with the issue of how to create quality inventory at a price that isn’t being driven down and down to a dollar. We believe in premium quality, that’s what we believe in terms of our inventory as well. That is also going on at the same time as we want to maintain the kind of traffic levels and growth that we’ve had.

Over the last couple of years, the increase in the consumption of our content on smartphones, on tablets, has been enormous. We’ve just seen a really big uplift in that. It’s less clear, in some cases, how that is going to convert into serious dollars. As you know, digital dollars are in many ways smaller than print dollars. But we do see terrific growth in the consumption patterns of people wanting to consume in this particular way. So we feel we have to recognize that in the way we offer our offerings to the reader.

Every media company with ambitions for the future, rather than just managing downwards, is looking to improve its ability to both collect, interpret, and use data to help them in the market.

We’re not doing the same for the person who only buys one or two days a week. We’re asking them to pay $4.99 a month, and we believe that’s a pretty modest extra for getting this. But we’re also mindful of the fact we can bundle print and online together. I’m sure you know The New York Times story: the claim that they have seen an uptake in New York Times Sunday paper subscriptions since they bundled it with their digital offering. People who were previously just digital only have now signed up to take the Sunday paper. So they are seeing a lift in their traditional print sales at the same time they are seeing growth on the digital side.

Our feeling from taking the surveys we’ve done of our readers, there’s a strong loyalty — a lot of our subscribers have been with us for a long time. The majority have a predilection towards having a print version as well as a digital delivery option. So this is not an either/or choice — this is “as well as.” What we see is a willingness to pay when it is made convenient and easy to do, and that you don’t have to have three or four different screens with three or four different setups. Everything works the same if you’ve got the kind of delivery that we are offering.

As an industry the newspaper business, the media business, whether you are in TV or newspapers, you need to be able to assemble more intelligent data. That is a big push for us and we will certainly be expecting to have a richer set of data as a result of this.

We believe with the kind of audience we’ve and can reach on a national basis, that if we collect more data on that audience from a digital point of view, a digital behavior point of view, consumption patterns and how people respond to ads — that strengthens our story. We believe this is an important advantage to us by being able to paint a better picture of that audience. We already have lots of data, but we increasingly recognize that what we’ve got to do is bring it all together, synthesize it, interpret it, take it back out to the market.

We’ve expanded our network of bureaus around the world at a time when lots of other newspapers have been cutting back on their basic newsroom coverage. They’ve cut back on local councils, they’ve cut back on coverage of the arts — they’ve cut back on lots of things, and the readers have noticed. To my point at the beginning, if you go behind a paywall and find really nothing that you can’t find anywhere else, clearly I don’t think you’re going to keep paying for it. You have to be convinced there is something really worth having.