Facebook, Snapchat, and other social platforms have dominated conversations around journalism over the past year. While publishers have flocked to tools like Facebook Live, Instant Articles, and Snapchat Discover to reach new audiences, they’ve also worried about changing revenue models and the threats platforms pose to their businesses.

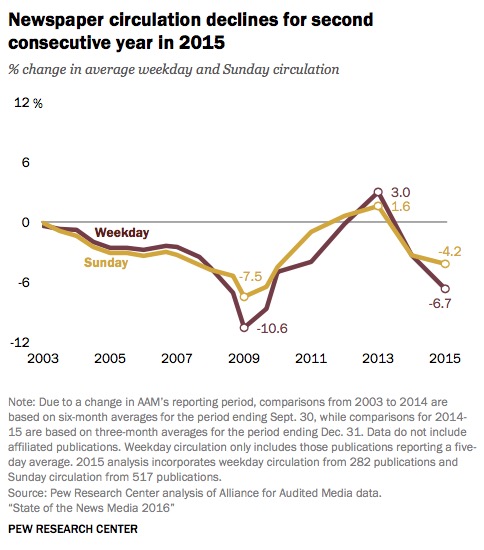

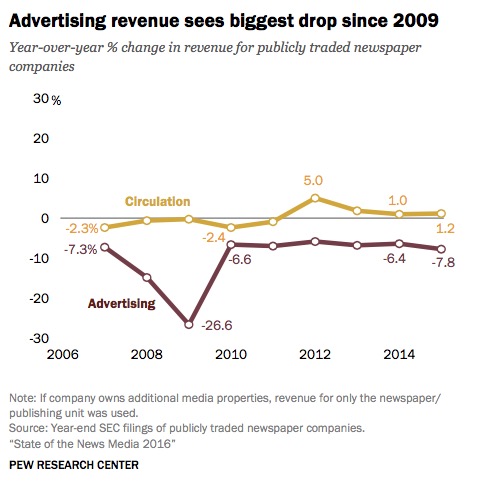

The Pew Research Center on Wednesday released its annual State of the News Media report, which examines these trends and shows that digital technology continues to upend the news industry. Nearly half of American adults now get news from Facebook, Pew found. Daily newspaper circulation fell 7 percent from 2014 to 2015, and newspaper ad revenue fell 8 percent over the same period.

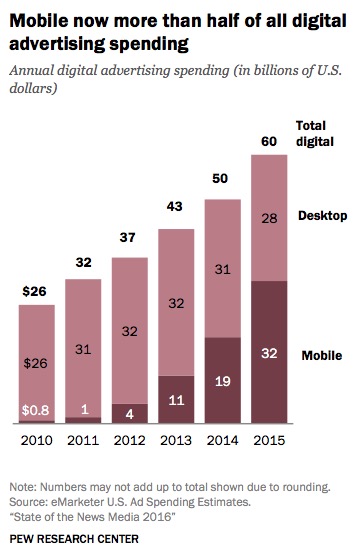

Spending on mobile advertising grew by 65 percent between 2014 and 2015, Pew said. In 2015, $31.6 billion, or 53 percent of total digital advertising, was spent on mobile ads. “While that is a steep climb for mobile, the rate of growth is down from recent years, when growth rates were in the triple digits,” the report’s authors write. Still, mobile accounted for 17 percent of the $183 billion that was spent in media advertising on all platforms in 2015.

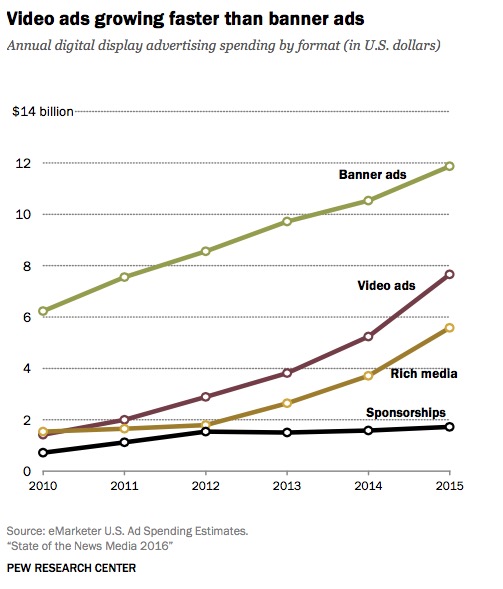

Video advertising spending climbed 46 percent to $7.7 billion in 2015, accounting for 29 percent of display advertising.

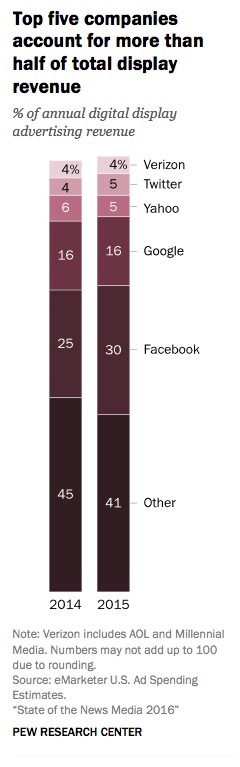

Five companies — Google Facebook, Yahoo, Microsoft, and Twitter — took home 65 percent of the $59.6 billion that was spent on digital advertising in 2015 (up from 61 percent in 2014). Facebook alone accounted for 30 percent, or $8 billion, of display ad revenue, up from 25 percent in 2014.

“Increasingly, the data suggest that the impact these technology companies are having on the business of journalism goes far beyond the financial side, to the very core elements of the news industry itself,” Amy Mitchell, Pew’s director of journalism research, and Jesse Holcomb, Pew’s associate director of journalism research, write in the report.

“Increasingly, the data suggest that the impact these technology companies are having on the business of journalism goes far beyond the financial side, to the very core elements of the news industry itself,” Amy Mitchell, Pew’s director of journalism research, and Jesse Holcomb, Pew’s associate director of journalism research, write in the report.

In the predigital era, journalism organizations largely controlled the news products and services from beginning to end, including original reporting; writing and production; packaging and delivery; audience experience; and editorial selection. Over time, technology companies like Facebook and Apple have become an integral, if not dominant player in most of these arenas, supplanting the choices and aims of news outlets with their own choices and goals.

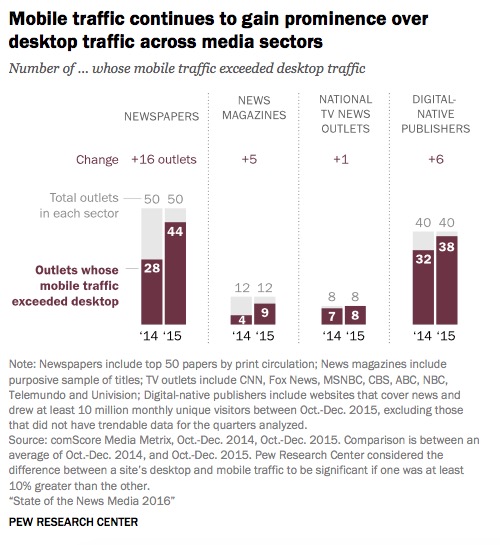

News consumption in 2015 also continued to shift to mobile. Pew compiled a list of 110 outlets — consisting of newspapers, magazines, national TV organizations, and digital-only publishers — and of those, 99 had more unique visitors to their mobile sites than their desktop sites.

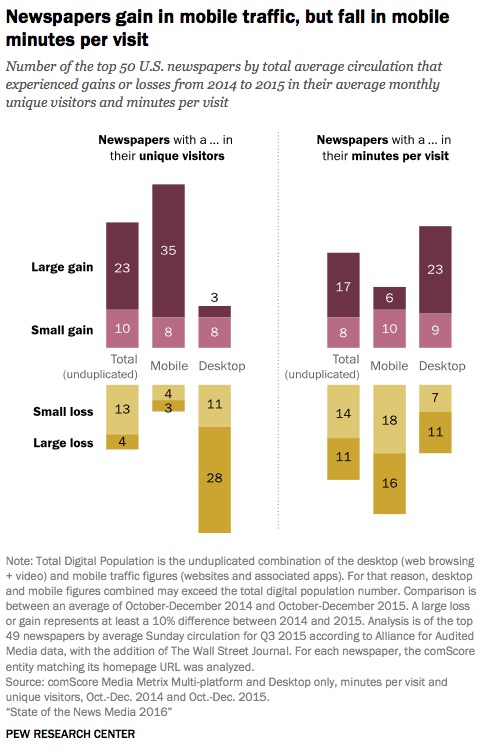

At the websites of 44 of the top 50 U.S. newspapers, mobile unique visitors outpaced desktop unique visitors by at least 10 percent. Thirty-nine of the top 50 U.S. newspaper websites saw unique visitors on desktop fall; desktop traffic at 28 of the newspapers dropped by at least 10 percent. Similarly, 43 of the top 50 newspapers experienced growth in mobile unique visitors, with 35 of those growing by 10 percent or more.

The full report is 119 pages long and covers a number of different sectors, including cable, network, and local television; audio and podcasts; ethnic media; alternative weeklies; and more. If you want specific details about any of these areas, you should read the full report, but here are some more highlights.

Weekday and Sunday newspaper circulations experienced their greatest declines since 2010, according to Pew. Similarly, newspaper advertising revenue had its biggest decline since 2009. But even as general news audiences move toward digital — especially mobile — consumption, newspapers remain heavily reliant on print.

Print comprised 78 percent of weekday circulation and 86 percent of Sunday circulation in 2015, Pew said, and only three newspapers had a higher average weekday digital circulation than print circulation.

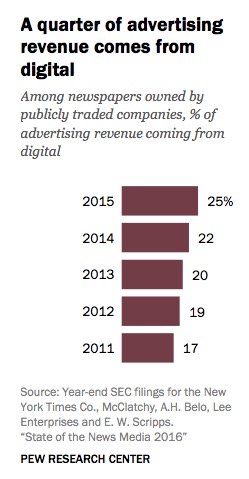

“Gains in digital ad revenue…have not made up for the continued decline in print revenue,” according to the study.

“Gains in digital ad revenue…have not made up for the continued decline in print revenue,” according to the study.

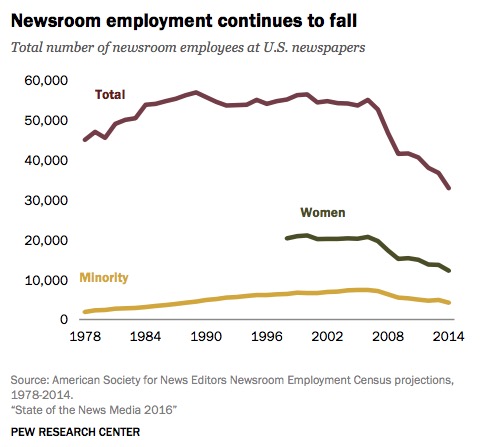

The number of people working in newspaper newsrooms also continues to fall. In 2014, the most recent year of data available from the American Society of News Editors, newsroom employment fell 10 percent to 32,900. Between 1994 and 2014, newsrooms lost more than 20,000 jobs — a 39 percent decline. (Data from the U.S. Bureau of Labor Statistics shows that there now more Americans working for digital-only outlets than newspapers.)For the five companies that broke out digital vs. non- digital ad revenue for 2014-2015, non-digital ad revenue declined 9.9 percent, while digital’s decline was less steep (-1.7 percent). (The remaining companies did not provide a digital/non-digital breakdown in their SEC filings.

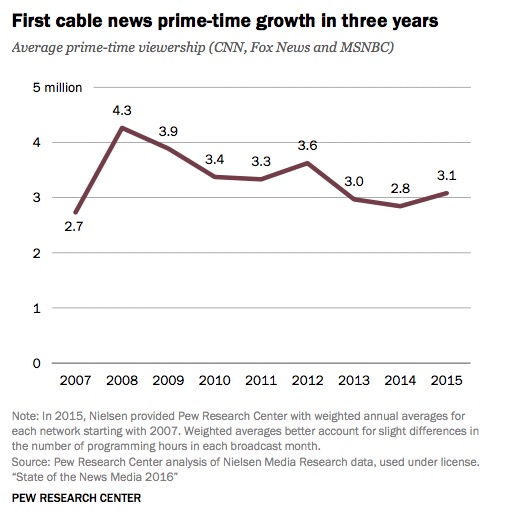

Primetime viewership for cable news grew in 2015 for the first time in three years as the wild U.S. presidential primary campaign attracted viewers. Average primetime viewership for CNN, Fox News, and MSNBC was 3.1 million, an 8 percent increase, Pew said, citing Nielsen Media research data. Daytime viewership increased 9 percent to 2 million in 2015.

At the three major cable news channels, total revenue was projected to climb 10 percent to $4 billion. CNN, Fox News, and MSNBC also collectively boosted their newsroom spending by 2 percent to $1.9 billion, Pew reported, citing SNL Kagan projections. CNN was projected to

increase its spending by 2 percent to $817 million; Fox was projected to increase its spending by 3 percent to $828 million; and MSNBC was 3 projected to decrease slightly by 1 percent to $291 million.

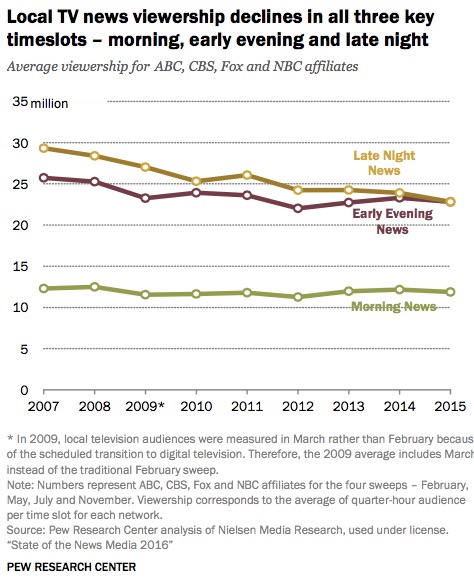

Local television news, meanwhile, lost viewers in every time slot. The audience for late-night local news programs fell by 5 percent between 2014 and 2015. Since 2007, the average audience for late night news programs has fallen by 22 percent. In 2015, morning and early evening newscasts saw slower declines of just 2 percent from the year before.

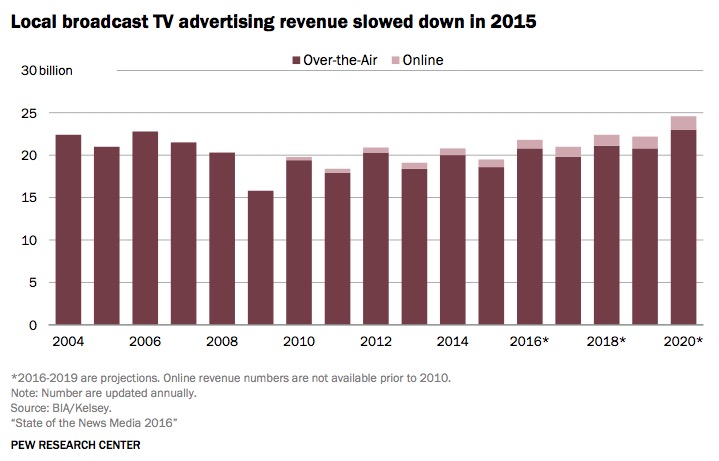

Still, as the 2016 election heats up, local TV stations expect their audience and revenue to grow. Local TV stations typically see an influx in ad money during election years. In 2015, for example, local TV advertising fell 7 percent from 2014, but Pew projects advertising to pick up again in 2016.

“U.S. adults continue to report turning to local TV in greater numbers than many other news sectors such as radio, print newspapers and network news, even for national news such as the 2016 presidential election,” the report’s authors write. “But research has also found that the local TV news audience tends to skew older, with younger adults more likely to turn to digital media for their news.”

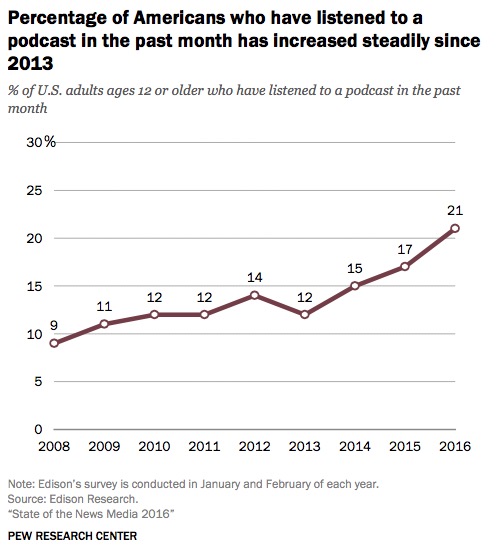

Twenty-one percent of Americans age 12 and older have listened to a podcast in the past month, Pew said, citing Edison Research. That’s an increase from just 12 percent in 2013. Thirty-six percent of Americans say they have listened to a podcast at least once.

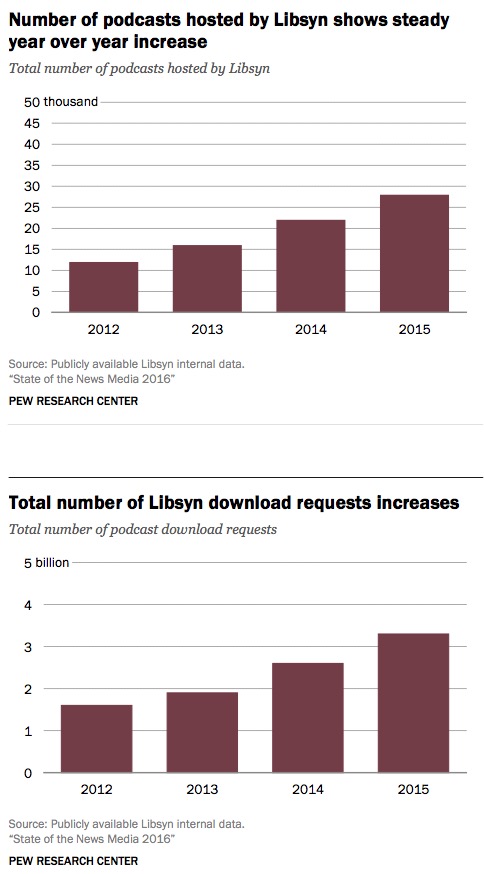

While there’s no estimate for the number of podcasts produced in the United States, Libsyn, one of the leading podcast hosting companies, said it hosted 28,000 shows in 2015, up from 22,000 in 2014. Libsyn also had 3.3 billion download requests in 2015, an increase from 2.6 billion in 2014.

“Still, even though more people are listening to podcasts, it is worth noting that the medium accounts for only a very small sliver of the share of time that Americans spend listening to all audio sources,” the report’s authors write.

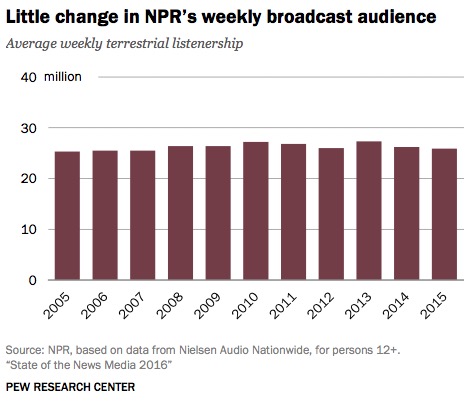

Fifty-four percent of all listening still occurs on FM radio. And one news organization that took advantage of the continued strength of broadcast radio was NPR. Amid fierce debate over the role of NPR’s digital outlets, its terrestrial broadcast listenership held steady in 2015 at about 26 million average weekly listeners.

Downloads for NPR’s core news apps on Android, iPhone and iPad apps all fell in 2015, but NPR One was downloaded 371,00 times on Android and 283,000 times on iPhone in 2015.

The full report is here.