One of the most unusual experiments in media ethics — and in news business models — is now live.

The Financial Times was first to write about Hunterbrook Media, back in October, with this explanation of the odd setup:

A group of veteran US financial journalists is teaming up with investors to launch a trading firm that is designed to trade on market-moving news unearthed by its own investigative reporting.The business, founded by investor Nathaniel Brooks Horwitz and writer Sam Koppelman, would comprise two entities: a trading fund and a group of analysts and journalists producing stories based on publicly available material, according to several people familiar with the matter.

The fund would place trades before articles were published, and then publish its research and trading thesis, they said, but would not trade on information that was not publicly available.

The start-up, called Hunterbrook, had raised $10mn in seed funding and is targeting a $100mn launch for its fund, according to two people involved.

Got that? Reporters dig up a story about a publicly traded firm. But before the story runs — and the market moves accordingly — their corporate sibling will buy, short, or otherwise trade the firm’s stock in anticipation of the move. Step 3: Profit!

This is, from a traditional journalism perspective, rather bonkers. Business reporters are generally expected not to trade individual stocks, much less the stock of a specific company they’re investigating. In this case, it isn’t the reporters doing the trading — it’s their bosses. Or, more specifically, their bosses who happen to run a corporate sibling. (Hunterbrook Media is the news operation; Hunterbrook Capital does the trading; Hunterbrook Foundation is a “non-profit affiliate.”) My fellow internet old-timers may recall Mark Cuban launching something similar called ShareSleuth back in 2006; it’s still around, publishing an investigation or two per year. Hindenburg Research and other activist short sellers play in a similar space.

Hunterbrook’s staff page is the only one I’ve ever seen that lists its “General Counsel & Chief Compliance Officer” ahead of its CEO or publisher. Its editorial team is remarkably global; along with three “investigators,” Hunterbrook lists seven freelance correspondents, based in India, Brazil, Peru, Namibia, Mongolia (!), southeast Asia, and southern Africa. Its advisors include some journalism heavy hitters — Paul Steiger, Dan Okrent, Bethany McLean, Matt Murray.

So how does this work in practice? Hunterbrook published its first investigation Tuesday afternoon, about United Wholesale Mortgage (UWM); here’s its summary:

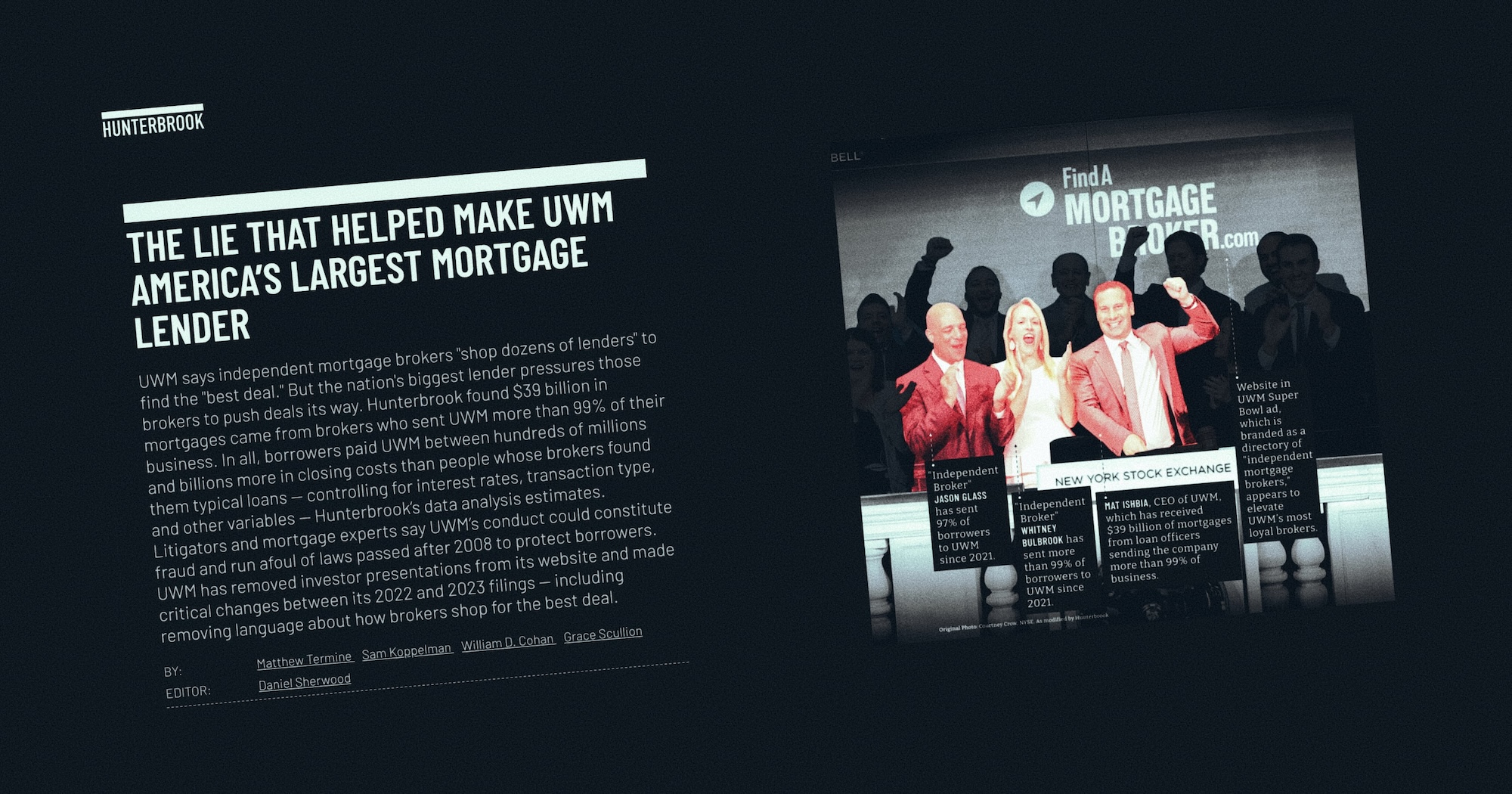

UWM says independent mortgage brokers “shop dozens of lenders” to find the “best deal.” But the nation’s biggest lender pressures those brokers to push deals its way. Hunterbrook found $39 billion in mortgages came from brokers who sent UWM more than 99% of their business. In all, borrowers paid UWM between hundreds of millions and billions more in closing costs than people whose brokers found them typical loans — controlling for interest rates, transaction type, and other variables — Hunterbrook’s data analysis estimates. Litigators and mortgage experts say UWM’s conduct could constitute fraud and run afoul of laws passed after 2008 to protect borrowers. UWM has removed investor presentations from its website and made critical changes between its 2022 and 2023 filings — including removing language about how brokers shop for the best deal.

We launch, today, with our investigation of UWM.

UWM says independent mortgage brokers "shop dozens of lenders" to find the "best deal." But the nation's biggest lender pressures those brokers to push deals its way. Hunterbrook found $39 billion in mortgages came from brokers… pic.twitter.com/m7yqOkiixp

— Hunterbrook (@hntrbrkmedia) April 2, 2024

“We fucking took those cocksuckers down, fuck them, and we’re gonna keep fucking sticking it to them forever.” — Mat Ishbia, CEO of @UWMlending, owner of the @Suns pic.twitter.com/oRFEA7VSRn

— Hunterbrook (@hntrbrkmedia) April 2, 2024

It’s a good, knotty story! The reporting seems very strong, of the same caliber as what you’d find in top national business news outlets. (Both Murray — former editor of The Wall Street Journal — and McLean — famed for breaking the Enron scandal — are listed as editors on the story.) But next to that reporting, Hunterbrook lists all the steps it has taken (and plans to take) because of its findings. It’s something I’ve never seen before, so I’m just going to paste the whole thing:

Editorial Position:Hunterbrook Media believes change starts with awareness, but doesn’t end there. Accountability requires action. Hunterbrook Media and its affiliates have taken several actions:

- Submitted data analysis and research — as well as the planned date of publication — to Boies Schiller Flexner LLP, a litigation firm known for winning billions in damages from companies. Hunterbrook’s nonprofit affiliate has entered an agreement with BSF in exploration of a class action lawsuit against UWM seeking restitution for homebuyers. If you think you are paying too much on your mortgage, visit WasIRippedOff.com to learn if you might have used an independent broker who doesn’t shop and contact BSF.

- Shared key findings with federal regulatory agencies with direct responsibility for the mortgage sector and non-bank lenders including UWM.

- Sent letters detailing the data analysis to Attorneys General in states where brokers have a legal duty to borrowers — as well as state regulatory agencies with direct responsibility for the mortgage sector and non-bank lenders including UWM.

- Two of the authors of this article filed a whistleblower report to the S.E.C. represented by a former S.E.C. Commissioner. One, Matthew Termine, is also a party to the Hunterbrook nonprofit affiliate’s agreement with BSF.

Upon publication, Hunterbrook Media plans to share this article and the data with:

- Civic advocates who focus on fairness and reform in housing and mortgages;

- Shareholder litigation firms whose clients own $UWMC shares and may have claims due to UWM’s governance and performance, including paying the CEO and his family over $600 million in annual dividends despite reporting a $70 million loss in 2023 by consistently missing SPAC revenue projections; and

- The consortium of brokers already suing UWM for antitrust violations.

Hunterbrook Media is continuing to report on UWM, including the critical audit matter of UWM’s Mortgage-Servicing Rights (MSRs) and UWM’s overall Non-GAAP Adjusted EBITDA. If you have relevant publicly-available information, please email ideas@hntrbrk.com and one of our legal colleagues will review your message before potentially sharing it with our reporters.

Hunterbrook Media’s Editorial Board believes that UWM has potentially committed fraud, would likely lose business and gain-on-sale margin if brokers fulfilled their fiduciary duties, and could face material legal and regulatory consequences — from civil, state, and federal accountability. UWM’s contracts with its credit lenders; contracts with its mortgage purchasers like Fannie and Freddie; and the CEO’s ownership of an NBA team — which was reportedly collateralized by billions of dollars in $UWMC shares — may also be at risk, Hunterbrook Media believes.

Hunterbrook Media also does not view UWM’s large dividend as sustainable, particularly in light of the company’s net loss of $70 million last year, compared to the over $600 million in dividends paid to the CEO and his family each year.

Due to this editorial opinion and with compliance review, Hunterbrook Media provided the article to its investment affiliate, Hunterbrook Capital.

Hunterbrook Capital took the following positions: The fund went short $UWMC, long $RKT, and purchased derivatives.

This is not investment advice. Positions may change after publication. See full disclaimer below.

Whoa. Prepping a class-action suit, filing a whistleblower claim, shorting UWM’s stock (and buying that of its rival Rocket Mortgage) — it brings new meaning to the term “activist journalism.”

As you might expect, UWM is not a fan of this new model of journalism, telling the FT that the story is “riddled with inaccuracies” and that “Hunterbrook is not a news organization. It is a hedge fund sensationalizing public information to manipulate the stock market to enrich themselves and their investors.”

A statement from UWM on this morning’s story from Hunterbrook Media about Suns owner Mat Ishbia and UWM: pic.twitter.com/CZ0HIL0bFB

— Gerald Bourguet (@GeraldBourguet) April 2, 2024

Also as you might expect, Hunterbrook defends its approach. It lists its two core principles as: “What we do must always be ethical. What we do must always be legal.” (I’d note that “We don’t break laws” usually doesn’t merit such a prominent organizational commitment.) Here’s its “Dear Reader” introductory note:

We know this may not be seen as traditional journalism, which is generally known for being dispassionate, reliant on inside sources, and indifferent to profitability. We are proudly passionate. We avoid talking to insiders, depending instead on publicly available information. And we believe that good reporting can be good business — when you monetize insights instead of eyeballs and align profits with accuracy.Smarter people have tried and failed to find a sustainable model for reporting. We know this may not work. We also believe it’s a hypothesis worth testing. Whether or not we succeed, we’re confident this team will publish meaningful reporting — starting today with what we believe to be the biggest mortgage scandal since the financial crisis.

So…did it work?

UWM stock finished the day down 8.5% — which would be good news for short sellers like Hunterbrook. But it’s hard to know how much to attribute that to the story specifically; UMC’s share price had already fallen 10.4% between Monday morning and the story’s publication Tuesday. UMC dropped 4% between 12:20 and 12:30 p.m., when the story was first tweeted out — but it had regained that 4% by 12:50. At this writing (11 a.m. Wednesday), UWM is trading at $6.05 — down 6.2% from the time of publication and 16% since Monday morning. Meanwhile, shares of UMC’s chief rival Rocket Mortgage are also down: 1.4% since publication and 8.2% since Monday morning.

A bit of a mixed bag, overall — so maybe this investment call didn’t wow on Day 1. But having raised $100 million, they’ll get plenty more chances.