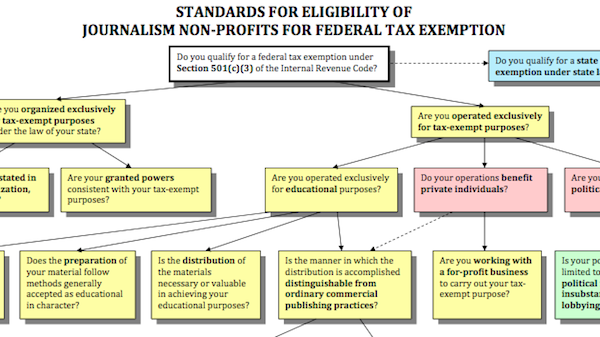

Last month we told you that our friends at the Digital Media Law Project were working on a guide for how nonprofit journalism organizations can increase their odds of getting 501(c)(3) status from the IRS. The good news: It’s now officially released to the public, in interactive guide form. (You can also download a 31-page PDF.)

“Guide to the Internal Revenue Service Decision-Making Process under Section 501(c)(3) for Journalism and Publishing Non-Profit Organizations” is, well, pretty much what the title suggests. It’s a concise, point-by-point look at how the IRS figures out who gets nonprofit status and how journalists can determine whether their organization makes the cut.

What will you find in the guide? Think of it as an SAT prep kit, with a run through of the tests organizations need to pass in order to be considered for 501(c)(3) status, the various authorities (IRS code, Treasury regulations, federal court cases, among others) whose rulings influence the IRS decisions, and a thorough explanation of what it means to have an “educational” purpose in the eyes of the IRS.

When I spoke last month with Jeff Hermes, director of the Digital Media Law Project (née Citizen Media Law Project) and author of the report, he said one of the biggest hurdles to nonprofit news organizations is misunderstanding that journalism itself does not qualify as a purpose for a nonprofit to the IRS. That’s why most journalism nonprofits claim to be educational in nature — but that’s still insufficient, as Hermes writes in the guide:

However, it is not enough that an applicant believes that is is educational in a general sense. Journalism organizations frequently fail to receive exemptions because they either (1) fail to understand the specific legal contours of the educational category, or (2) try to stretch the category to fit their business models rather than design their business models to fit the category.

Hermes writes that nonprofit news providers need to be careful how they partner with commercial news organizations. Partnering can be a great way of distributing content and generating money, but these collaborations can be a red flag to the IRS:

A complicating factor is that journalism non-profits often collaborate with for-profit businesses or work through for-profit channels to achieve their exempt purposes. For example, a non-profit news outlet might distribute its content to a regular commercial broadcaster for dissemination. Such interaction with for-profit businesses will not automatically disqualify a non-profit for exemption, but the non-profit should be careful to keep the line between its operations and those of its partners clear.

How a nonprofit makes its money is very significant in the eyes of the IRS, and any potential nonprofit news outlet would be wise to read the sections of the guide on how traditional revenue models for news can be applied in a nonprofit setting. As Hermes told me in our previous conversation, the IRS wants to see charitable intent — evidence that you’re trying to make money for your operating budget through the channels a nonprofit typically uses. That said, there are

Despite this preference for keeping revenues from advertising and subscription below cost, ‘it has been recognized that it is often necessary for an organization to earn a profit from a business activity in order to carry out its charitable purpose.’ In Pulpit Resource, the Tax Court held that a modest profit made by a religious publisher from subscription fees did not disqualify it for a tax exemption, where the record reflected that the publisher had attempted but failed to raise funds in other ways and donated its profits to charity.

Needless to say, if you’re forming a nonprofit news organization or already in the middle of the 501(c)(3) process, it would be worth the time to read the entire document. If you’re looking for more definitive help navigating the IRS, get in touch with the Online Media Law Network, a project of the DMLP that helps connect online news outlets with legal assistance, including help with 501(c)(3) applications.