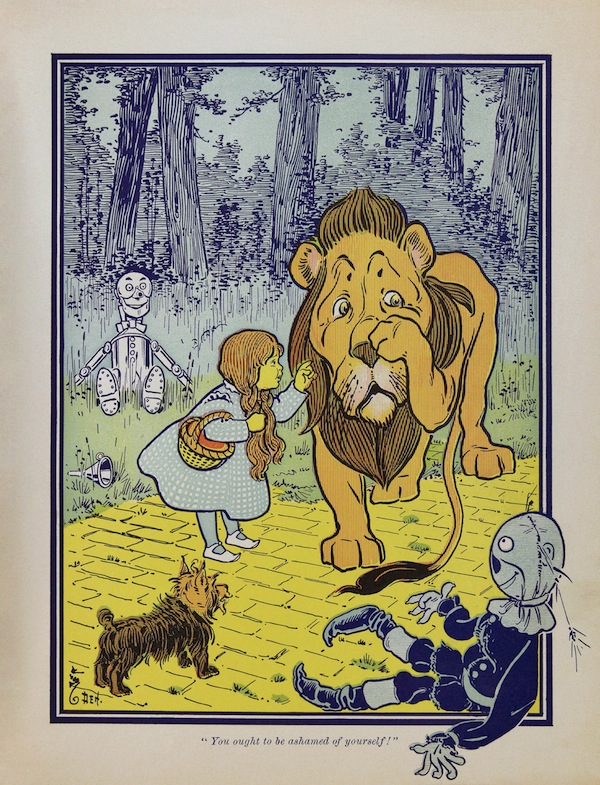

It takes at least three special qualities to be in — much less to enter — the newspaper business these days. We can borrow them from L. Frank Baum: heart, courage, and smarts. 2012 marked unprecedented change in the top leadership and ownership at American dailies.

The end of the year is a good stopping point to consider the most influential captains of this industry. Who will prove lionhearted or chicken-hearted? Who, looking into the deepening abyss of advertising loss, can maintain fortitude? Who has the intel, or is acquiring it, to navigate a new course?

Certainly, news gathering and news distribution, a.k.a. journalism, in the second decade of the 21st century isn’t only about the poobahs. Here at the Lab, and in my Newsonomics columns over the year, we’ve focused much on innovation and the innovators. Surely, companies and products from KPCC, California Watch, The Lens, and Texas Tribune to NewsCred, Quartz, and The Huffington Post to The Verge and BuzzFeed are changing news as we know it. But they are changing it slowly. They are seeds — a few of which will sprout into major operations, while others will be hybridized into news creatures yet unborn. (It also isn’t just about the U.S., though we can be myopic about that. Check out CJR’s recent piece on cutbacks in the European press.)

Today, though, most of the reporting power, much of the brand power, and the political power still resides in big companies and their leadership. We may well get our strongest display of that early in 2013: In Washington, the FCC cross-ownership debate may move to center stage in January. And around the same time, we’ll probably see the Tribune newspaper auction. As new Tribune CEO Peter Liguori, a broadcast exec, remakes the company as a TV/video shop (WGN America, here we come!), some of the most influential American nameplates — the Los Angeles Times, Chicago Tribune, and Baltimore Sun, among them — will all hit the market at one time. Though 2012 has been a time of unprecedented change, it may prove to be prologue to the year to come.

So let’s focus on 13 leaders — would-be, wannabe wizards of a kind — as we countdown to the new year, nostalgically remembering that yesterday’s oracles (Media General’s “Down from the Mountaintop” Marshall Morton, or financier extraordinaire-turned-charlatan Sam Zell) didn’t always work out so well. Feel free to photoshop their faces into your favorite scarecrow, tin man, and lion portrait.

Taking over as CEO in July, Pruitt left one fireman’s job for another. He tamped down blazes as longtime CEO of McClatchy, paying down debt from the ill-fated 2006 Knight Ridder purchase, cutting expenses and testing digital strategies along with his peers. At the wire, he succeeds Tom Curley, really the first modern AP head. Curley started a vast transformation of AP, and quelled a rebellion of its newspaper owner/members. Now Pruitt must rationalize the pieces of the business. Those newspaper owners only contribute 22 percent of the company’s revenues, yet they control it, with Lee Enterprises CEO Mary Junck, one of the most commonsensical news execs, now chairing the board.

The impact of AP’s 2,300-strong news-gathering corps remains hugely impactful and eternally underestimated. Pruitt and his team must now figure out where a modernizing wire plays in an evolving world of socially driven, tech-improved aggregation and curation. As competitor Thomson Reuters spent much of the year re-strategizing its own media business future, letting go much of that division’s leadership and not making much headway with Reuters America, AP had a bit of a breather. Expect hyper-competition to pick up in 2013 from a host of giants like Bloomberg and the new News Corp. and an assortment of niche sports, entertainment, and news sites.

Consistent rumor in L.A. places Carlos Slim as one of the potential bidders for the Los Angeles Times, as the post-bankruptcy Tribune Company gets its newspaper auction into gear. Why not? The globe’s richest human, Slim already has shown an interest in newspapers, his usurious depth-of-the-recession deal with the New York Times being one example. Media and telecom are cousins, and América Móvil is his signature company, with almost 40 percent mobile market share in Latin America and the Caribbean. As that company gets increasing pressure from regulators, why not head north (as Murdoch moves west) and exploit more of the California market, which itself is almost 40 percent Latino. Even if Slim paid $300 million for the Times, which is probably a high price, it would amount to a rounding error amid his $68 billion fortune.

At 39, Kushner is the youngest on this list, and maybe the most bullish about newspapers. That’s news on paper: Dubbed the Pied Piper of Print by OC Weekly, Kushner makes the direct, and public, connection between unique local content and reader revenue that only a few of his contemporaries do. Kushner’s strategy is to deepen the essentiality of the Register, and then to put in a metered paywall, mimicking the success of the smartest implementers of all-access circulation strategies. That combo, if matched with a likewise next-gen advertising strategy, will become a business school case study — one way or the other.

Mr. Digital First has had to keep his head more publicly down in the second half of 2012, after his Journal Register Co. entered bankruptcy for the second time. There are all kinds of ways to read this bankruptcy (“Journal Register Co. declares bankruptcy…again: Is this the industry’s first real reboot?“) and to extrapolate the wins and losses of his prominent strategy.

Into 2013, we’ll be watching both this next JRC small-daily push and the company’s attempted remake of the larger MediaNews properties in L.A., the Bay Area, and Denver. Those digital transformations are of a magnitude higher than the JRC properties, and after more than a year of Digital First re-direction, that transformative strategy’s impact is still unclear. 2013 may be a make-or-break year for Paton.

It’s not a bad position to be in. As the tenth-richest American and finishing a third term running New York City, Bloomberg may well turn back to media for a third (at least) act for his Third Way agenda. Bloomberg the company is now a serious global business news player, and its Businessweek foray into consumer media appears to have boosted the company’s confidence in a more-than-B2B future. So, Bloomberg’s been floated as a potential buyer of both the Financial Times, if Pearson actually puts the paper on the market, and, in recurring rumor, The New York Times.

The Times won’t be for sale until Mark Thompson has taken a shot at finding a new growth path, but could be within two to three years. The FT may be more likely, and the big metros, like the L.A. Times and Chicago Tribune, may make less business alignment sense — but provide the kind of powerful journalistic platform that Mike Bloomberg 3.0 could relish. Into 2013, we’ll have to wonder: Could Bloomberg be the anti-Murdoch?

As the chasm widens between the go-forward abilities of the national/global news outfits and the regionals, these two regional publishers stand out for forward thinking — and action. Wednesday, the Morning News announced another acquisition — its fifth buy or startup in 2012. This acquisition is local and niche: DG Publishing, a magazine publisher of high-end resource guides including Design GuideTexas and The Texas Wedding Guide. It follows investments in marketing services (Dallas 508 and Speakeasy) and in the events business. Klingensmith, a magazine (Time Inc.) guy brought into the newspaper business, post-Strib bankruptcy, has implemented one of the highest-achieving paywalls in the country and is now going full tilt into marketing services as well.

Both publishers see the news landscape for what it is: hugely challenging in advertising, offering unexpected reader revenue — and making possible third and fourth streams of revenue that only optimism that investment can grab.

Wilson is no longer a newspaper guy, though he won plaudits for his editorship at USA Today. His potential impact on local news, though, could be huge. He and his new boss Gary Knell, who has been on the job a year, stand at the nexus of public media in the U.S. It’s a crowded intersection, with lots of jostling, more than a few historical accidents, and no clear traffic improvement plan…yet. Watch for how much progress Wilson and the alphabet soup of innovators and incumbents — CPB, PBS, PRI, APM, PRX, plus the power center regional stations (WNYC, WBEZ, WBUR, KPCC, KQED, MPR, OPB, and more) — can make as they try to create the Public Media Platform, which issued a 2013 announcement just Monday.

For us public media consumers, it’s a snap to say what we’d like. We’d love to see a consistent set of public media apps that work across the web, smartphones, tablets, and connected cars. You know, just let us pick our favorite stations, programs, and personalities, local or national, by time of day or week, and import. Yet just as with AP and newspapers, or TV networks and their local affiliates, money and power divisions continue to hamper satisfying clear consumer want. Wilson wins much credit for his collegial style, but it’s far from clear that he can untangle historical divisions that prevent public media from making the most of the all-access age.

You have to give Genachowski credit. He’s taken on many issues and constituencies over his first term as FCC chair. Now he’s trying to impose science on the banal restrictions airlines put on mobile device usage. Whether he gets a second term or not, he’ll be remembered by news media for what does or doesn’t happen with cross-ownership in 2013. Out of the apparent blue, with no new hearings on the matter, he’s resurrected relaxed cross-ownership rules. These would make it easier, in the top 20 markets, for newspaper and broadcast companies to pool assets.

With scant evidence of potential value — no increase in news, in public service, or in survivability — the debate is an abstract one, with both newspaper owners and broadcasters lobbying for deregulation. Yes, in the tablet era, we should be entering a world of true multiplatform, multimedia news production — but it still rolls along on training wheels, much tougher to master than anyone had suspected. Beyond the abstract merits of “cross-ownership,” it’s easy to see one big, early winner of relaxed rules: News Corp. With broadcast properties in both Chicago and L.A., a possible bid for the Chicago Tribune and L.A. Times is much more appealing if both TV and newspapers could be controlled by the separate, if both Murdoch-dominated, new News Corp. and new Fox Group. While the News Corp. interest here is the juiciest news, a real change in the decades-only rules could lead to many unintended consequences in local news ownership.

Miller is a Brit, and he is based in London. But the Guardian is truly a global news source — an important one, with growing reach in the U.S. The Guardian has twisted and turned its U.S. presence, trying to figure out how the two words Guardian and America best fit together — and how they can be monetized. In October, it hired a highly recognized and authoritative U.S. voice, the Twitterrific Heidi Moore (ex- of Marketplace and the Journal) as its U.S. finance and economics editor.

Miller’s made some headway, but nearly enough yet, as the Guardian continues to lose substantial money, with an operating loss of more than $70 million. The uniqueness and differentiation of its journalism is clear, but matching that to paying digital audiences in the U.K., U.S., and Europe has proven more challenging than Miller, and most of his U.K. publishing colleagues, expected. Developing big out-of-home-country audiences is one things; making money off them is quite another.

A respected newsman, 10-year News Corp. veteran Thomson, is catapulting into a position heading the largest news enterprise, by revenue, on the globe, from his post as The Wall Street Journal’s top editor. He faces a slew of challenges, as the Australian dailies — long News Corp.’s publishing cash cow — restructure and retrench, the U.K. quality papers hemorrhage money, and The New York Post requires subsidy. Of course the Journal, with its emerging WSJ Digital Network, is the jewel here. This week’s subscriber notice that the Journal is succumbing to Apple’s rough charms and joining Newsstand reminds us, though, that even the Journal is in a tough fight for growth. Thomson’s opportunities — and challenges — could multiply if Rupert, the chairman to whom he’ll be reporting, adds newspapers to his portfolio.

Thompson knew he was taking on a tough job. Even with a high single-digit increase in circulation revenue, built on its paywall strategy, the Times’ ad decline is swamping that gain. So Thompson faces huge immediate challenges. For the Times — and the reason the British broadcaster was hired — that means in strong part an expanded global strategy. Yet, its forays into China (2012) and Brazil (2013) will take several years, at least, to make much revenue impact. Thompson is in race against time, as the Times battles competitors with much deeper pockets in the U.S. and worldwide; it’s on thinning ice. The cloud of the BBC child abuse scandal that hangs over his head may lift by mid-year — or make his tenure a short one.

As the year dawns, the anti-Times press will discover one — imagined or real — smoking gun after another about Thompson’s knowledge of the BBC wrongdoings. Yet this week’s release of the first of three inquiries into who-knew-what-when cleared the BBC and Thompson of conspiracy or cover-up — instead skewering the organization Thompson led for eight years as confused, chaos, and incompetent.

Want to find a buyer for a non-metro paper? Simple: Email Warren. That’s what the Allentown Morning Call found when it asked him directly if he’d consider buying the paper. “If the phone rings, I’ll answer it,” he told the paper. Berkshire Hathaway has no silver bullet, but as a long-term, buy-and-hold company, it recognizes beat-down assets that can be re-energized. BH Media head Terry Kroeger is clear that his company is searching for a new growth formula, along with its peers. Buffett’s advantage: the ability to buy cheap, offering deals others can’t, as with the financial engineering that made the Media General sale happen. Paywalls going up around the company will significantly help 2013 results.

Murdoch always commands attention. Much of that in 2012 was negative, as Hackgate appeared to change the trajectory of News Corp.’s news future forever. But “forever” is a short time in Rupertland. Though his head U.K. honchos are going in the dock for bribery, he and son James have moved the center of the empire west. Though originally interpreted as a loss for Rupert, the splitting off of the company’s three-continent newspaper assets looks as much like the start of something as the end of an era. Murdoch, with pockets as deep as $9 billion in cash, will have no trouble, if he wishes, outbidding others for the Tribune newspapers. While he paid $5.6 billion for Dow Jones a scant five years ago, he could take home the L.A. Times and Chicago Tribune for about a tenth of that.