The dream for any newspaper seeking to last longer than print itself is to transition its business model into digital. The New York Times is almost there.

The Times announced its fourth-quarter and full-year 2018 financials this morning, and there’s a lot of good news. (One quick heuristic I like to run with newspaper company earnings reports is searching the press release to see the ratio of “digital” mentions to “print” mentions. Today: 40 to 17.) The most important: The Times generated $709 million in digital revenue in 2018, putting it ahead of the ambitious goal it set out back in 2015 to hit $800 million in digital revenue by 2020. They’ll make that with little trouble — barring economic collapse, civil war, and so on.

Flush with confidence, Times CEO Mark Thompson laid out a new goal: “to grow our subscription business to more than 10 million subscriptions by 2025.” (He’s really formalizing a goal more than laying one out — 10 million subscriptions has been a Timesian aspiration for several years now. It has 4.3 million now, counting both digital and print.)The Times brought in a total of $1.748 billion in 2018, which means digital revenue accounted for just over 40 percent of the total. Given the trendlines in print and digital, it won’t be too long until it hits that 50 percent tipping point — I’d guess Q2 2020. (Times guidance projects digital advertising and circulation revenue to grow in the “mid-teens” from here, with overall revenue growing only in the “low to mid single digits.”)

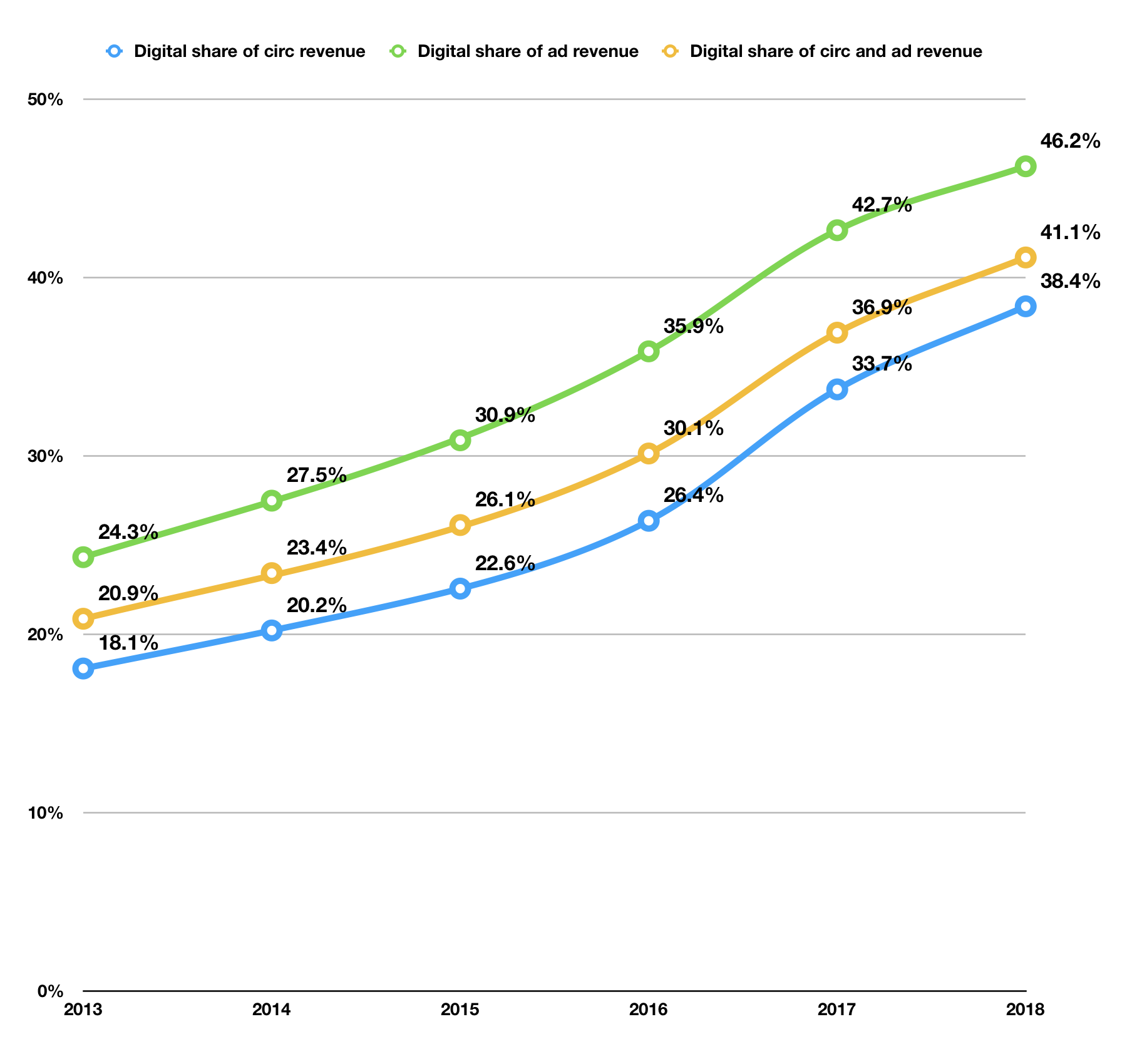

To show the progress the Times has made in this transition, I pulled the share of its advertising and circulation revenue that came from digital every year since 2013, when it started separating out digital circulation revenue. The trend is obvious and positive — the Times becomes less reliant on print revenues every quarter.

A common goal in newspaper circles a few years ago was to someday be able to make enough money in digital to cover the cost of the newsroom. Well, at this point, the Times could pay for the newsroom two times over with just digital money. Which is probably why that newsroom keeps growing — the Times reported it now employs 1,600 journalists, an all-time high.

Meanwhile, the company reports having $826 million in cash on hand. Even accounting for the expected cost of buying back its building later this year, the Times has enough money that it could think about significant acquisitions if it saw value. Is there another Wirecutter out there that could fit with Times values and diversify revenue? Is there something in Europe that could drive a spike in subscriptions there? A podcast studio that could multiply The Daily’s success?

As I advised last time: “Take 98 percent of whatever energy you devote to worrying about the future of the Times and rechannel it into worrying about your local daily, which is very likely approaching existential crisis.”