“Let’s enjoy it while it lasts” was a familiar reaction on social media when The New York Times announced last week that it would temporarily disable its paywall to mark World Press Freedom Day. The excitement of many users points toward a key development in online news of recent years: the rise of paywalls across online news sites, as publishers around the world try to find new, sustainable business models in order to make up for the revenue shortfall caused by a rapidly changing business environment.

Paywalls may seem to be everywhere these days, but how widespread are they in fact? This is the question Lucas Graves and I tried to address when we set out to survey the current pay model landscape across six European countries (Finland, France, Germany, Italy, Poland, and the United Kingdom) and the U.S.

When we first conducted a similar study in 2017, pay models had already spread across nearly two-thirds of newspaper sites in Europe. Two years have passed since then — eons in the rapidly evolving news environment — which is why we thought that it was time for a much-needed update. So what did we find?

For our study, we collected data from four broad categories of, in total, 212 news outlets: daily newspapers (up-market, tabloid/mid-market, business, and regional), weekly newspapers and magazines, TV news (commercial and public service media), and digital-born news outlets. We sorted pay models into three categories: hard paywalls, where no content is accessible for free at all; “freemium” models, made up of a mix of free and premium content; and metered paywalls, which allow access to a limited number of free articles each month.

Our data suggest that a growing number of news organizations across Europe and in the U.S. are challenging the assumption that people will not pay for digital news.

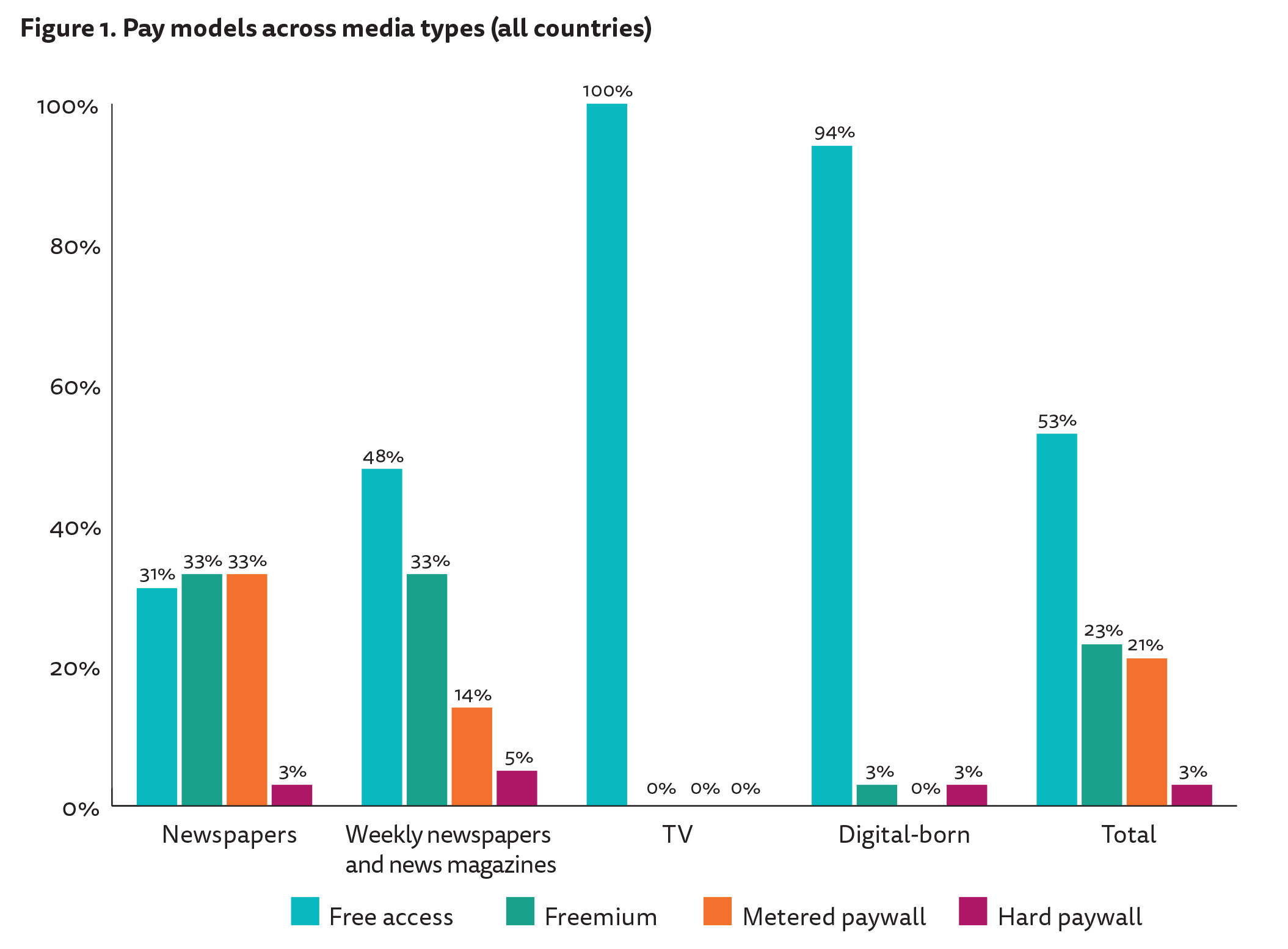

69 percent of the newspapers we surveyed now operate some kind of a pay model, a small increase from 64.5 percent in 2017. Hard paywalls — operated by outlets such as The Wall Street Journal and Financial Times — are extremely rare, with the landscape evenly divided between freemium models and metered paywalls (33 percent each). When it comes to weekly newspapers and news magazines, just over half (52 percent) operate a pay model, down 10 percentage points from 2017. Freemium models are the most widely used in this category, followed by metered paywalls and hard paywalls.

Where we saw little to no change was among broadcasters and digital-born news outlets. Just as in 2017, all broadcasters in our sample continue to offer free access to their digital news in 2019. This includes private sector broadcasters such as CNN or Fox News as well as public service media like the BBC in the U.K. or YLE in Finland. Similarly, almost all digital-born news outlets (94 percent) across our seven countries offer free access to their news, down a meager three percentage points from 2017.

Overall, things are looking up for those unwilling to pay for their daily dose of news. More than half of the news organizations — 53 percent of the 212 outlets we looked at — continue to offer free access to digital news. Still, it seems that the trend we first identified two years ago persists in 2019, with newspapers and news magazines across Europe and the U.S. gradually moving away from digital news offered for free and supported primarily by display advertising.

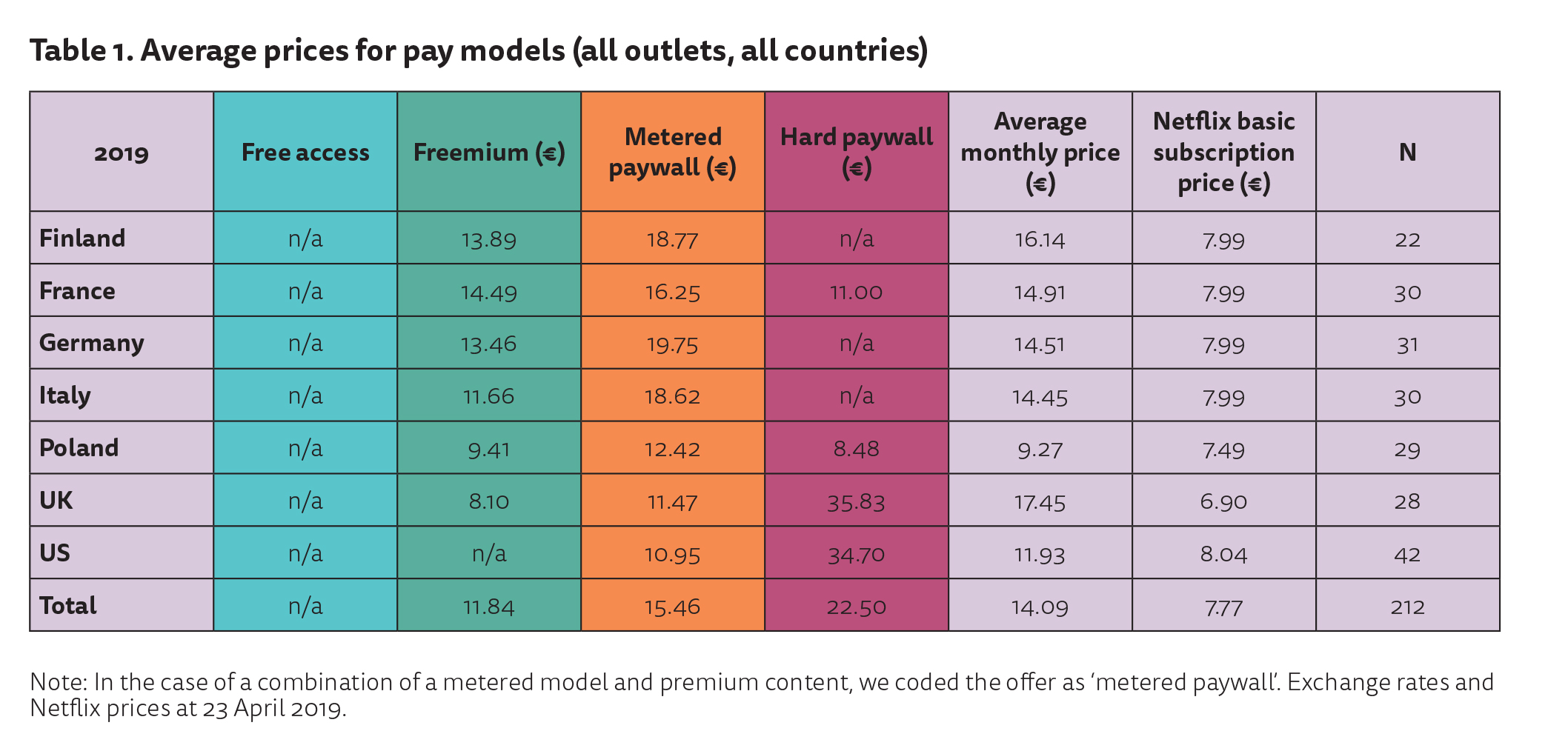

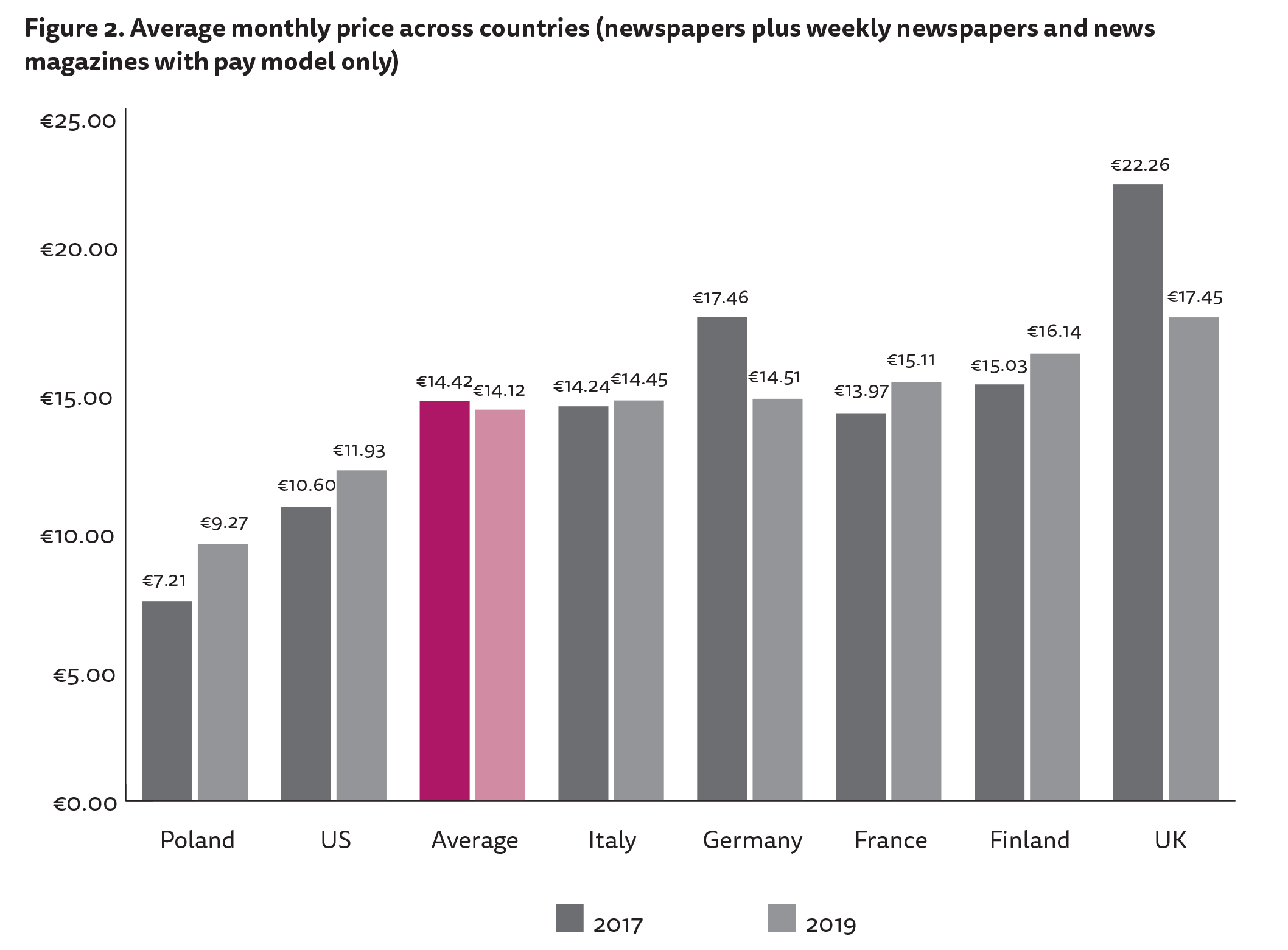

But how much exactly can we expect to pay for news online these days? We found an average price of €14.09 (USD $15.79, at 0.89 euros to the dollar) across countries for the cheapest available monthly subscription (without discounts), roughly similar to 2017. Prices range from as little as €2 to €41.50 a month. For comparison, the average price for a Netflix subscription across countries is €7.77.

Perhaps unsurprisingly, we see strong differences across titles and countries. Looking specifically at newspapers and weeklies, Poland has the lowest average monthly price at €9.27. And while the U.K. boasts the lowest percentage of newspapers and weeklies with pay models (33 percent), consumers have to reach particularly deep into their pockets, with an average monthly price of €17.45 for a news subscription.

As one would expect for such different media markets, there are significant differences between countries, not only in terms of price but also in the adoption of pay models in general. For instance, many Finnish newspapers rely on hybrid paywall models (a combination of a monthly pageview limit and some premium content), whereas the U.S. is dominated by metered paywall solutions.

The United States has also seen a sharper rise in paywalls than the EU. Some 48 percent of U.S. outlets in our sample have a paywall, compared to 38 percent in 2017, a 10 percentage point increase in just two years. This increase stems exclusively from newspapers, of which 76 percent have a pay model in place in 2019, up 16 percentage points from 2017. During the same period, the number of paywalls across the sample of media from EU countries covered in our study has stayed nearly flat, rising just one percentage point to 46 percent in 2019.

In many ways, 2018 was a difficult year for legacy media companies, especially newspapers; print revenue continued to decline with digital unable to make up the difference. In this climate, we are seeing a strategic split: as many publishers (particularly in complex and fragmented markets) continue to offer online news for free, much of the industry is making a renewed push to implement pay models as well as membership and donation models.

Overall, paywalls are likely here to stay. The trend we identified two years ago persists in 2019, with newspapers and news magazines across Europe, and particularly the US, moving away from digital news offered for free. Nevertheless, fears about paywalls limiting the access to quality information — with all the concomitant implications for democracy — seem overblown for now. Hard paywalls are extremely rare, even among newspapers, and a majority of outlets overall (53 percent) remain free to access for users.

The full report, including our methodology and sample of outlets, can be found here.

Felix M. Simon is a research assistant at the Reuters Institute for the Study of Journalism at the University of Oxford. Lucas Graves is the Reuters Institute’s acting director of research.