Imagine you’re a barista at a coffee shop. You may have no background in business, finance, or data analysis — but you still probably have a decent handle on how the company you work for makes money and what role you play in that process.

You know that each cup of coffee you sell costs the customer $2 or $3. The company makes that amount minus the cost of the coffee grounds and the cup, with some fixed overhead costs. If you sell more cups of coffee, or get customers to buy more expensive drinks, the company makes more money — and with even basic arithmetic skills, you can probably estimate in your head about how much more. If you waste supplies or work a slow shift, the company makes less money. Simple.

I’ve thought about this in recent years because I’ve spent a lot of time sitting in coffee shops crunching data about business models for digital news. A collection of benchmarks and best practices from that work was published in the digital pay-meter playbook, released last month in a partnership between The Lenfest Institute and Harvard’s Shorenstein Center.

Through the course of that reporting, it struck me that baristas — and most employees in other industries — have a better understanding of their roles in their organization’s overall business than journalists do.

Most journalists know only a few things about the companies they work for: They know the news industry, especially the local news business, is struggling. They may generally know that if their articles attract more pageviews, the company makes more money from advertising— though they likely have little sense of how much. And in the last year or two, they’ve probably heard an announcement or two from an eager executive about the company’s new, or newly emphasized, digital subscription or membership initiative.

What they don’t know are the answers to some important questions, like: How much revenue does a typical article I write generate from advertising? What if it goes viral? Is it better for my article to get lots of pageviews or for it to attract digital subscribers? How do those two goals relate? After all, the coverage that generates the most clicks may by completely different from the stories that attract subscribers.

Indeed, when trying to get basic metrics from publishers about the value of a subscriber, the marginal impact of a pageview on advertising revenue, and other key metrics, I found that many publishers either didn’t have clear answers or that the information was siloed — with the advertising people looking at the ad metrics, the subscription people looking at subscription metrics, and journalists looking at outdated metrics such as how often their articles made the front page of the newspaper. Nobody was looking at these metrics together to get a clear view of the business as a whole.

It’s time for the news industry to have a clear grasp on the unit economics of journalism content. And while we don’t yet have all of the answers, some of the research and metrics we’ve gathered to date can point us in the right direction.

There are a number of different metrics that can help journalists and news organizations understand their businesses better — but to start, publishers can go a long way by starting with just two key data points.

The metric publishers should know is customer lifetime value, a common metric in subscription businesses that looks at the average revenue generated by one new subscriber over the lifetime of the subscription.

There are many ways to calculate CLV, but in the simplest terms, it can be calculated by multiplying the average monthly revenue per subscriber by the expected lifetime of the digital subscription, meaning how long the average user will remain subscribed before they cancel. For a subscription business that averages $10/month per user and retains its subscribers for 20 months on average, the CLV would be $200. Every new subscription sold will generate, on average, $200 in new revenue.

The average revenue per subscriber can be calculated by dividing total monthly subscription revenue by total subscribers over a 6- or 12-month period. The average lifetime of a subscription can be calculated in a number of ways — some publishers have sophisticated retention curve models — but one simple and easy calculation that works for most purposes is:

1 ÷ monthly churn rate

This tells you the average number of months a subscription will last. Publishers who run paid advertising campaigns to acquire new subscribers may also choose to subtract the average cost per new acquisition — which is

total paid marketing spend per month ÷ total new subscribers generated per month

— from their CLV.

Our benchmarks show that a publisher performing in the 80th percentile — the typical range for a daily newspaper putting at least some effort into digital subscription sales — has a CLV of $217 for a digital subscriber. For publishers putting more focus on digital subscriptions the numbers can be substantially higher — often in the $300–$350 range.

Most publishers have some calculation of CLV used by their finance or consumer marketing departments — and if they don’t, they should. But beyond a relatively small team managing digital subscriptions, most people at a typical media company don’t know this number.

The second metric publishers can look at to understand the unit economics of their digital business is digital ad revenue per 1,000 impressions, also called RPM. In its simplest form, RPM is calculated by dividing digital ad revenue by total pageviews and multiplying that number times 1,000. Put simply, it tells a publisher how much ad revenue they generate for every 1,000 pageviews they serve.

However, while every publisher should know their overall RPM number, it can also be a bit misleading because not every pageview generates the same amount of ad revenue. Most publishers do not sell out all of their available inventory with high-rate, directly sold advertisements. Instead, at the margins, their pageviews are primarily monetized by programmatic ads that can yield relatively little revenue per pageview. If a publisher increases their pageviews marginally above their usual baseline, their increase in ad revenue primarily comes from this category of lower-yield advertisement.

For day-to-day editorial decisions, then, what may matter more is marginal RPM: the ad revenue generated from the next 1,000 pageviews a publisher might generate. For most publishers, this means RPM for programmatic advertising only.

It’s also best to look at this metric, if possible, for content pages only. Ads sold on the home page or section front pages are still relevant to the business, but are not relevant to the impact one article or another might have on the business.

Though we weren’t able to gather a full benchmark for this metric from hundreds of publications, my informal survey of publishers suggests that most publishers are monetizing their pageviews in the range of $20–$25 per thousand pageviews overall and in the range of $6–$10 at the margins, primarily from programmatic advertising. As with CLV, in many organizations, knowledge of this metric is largely siloed within the digital advertising department.

By knowing just these two basic metrics, publishers (and journalists) can learn quite a bit about the unit economics of their business and the value of their day-to-day work.

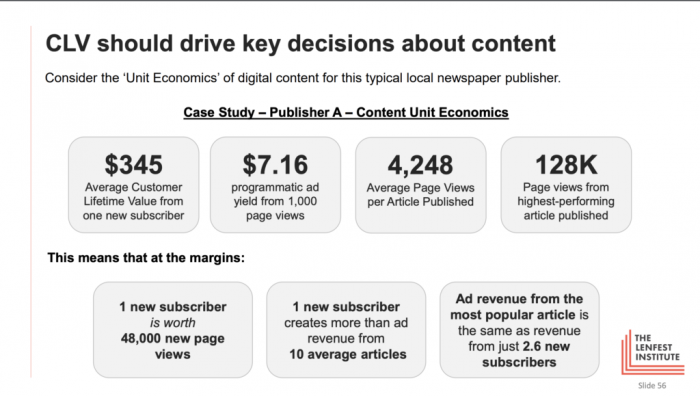

As a case study, consider this metro daily newspaper — we’ll call it Newspaper A — that was kind enough to share these two metrics and some basic traffic data with me.

Newspaper A has a customer lifetime value of $345, a bit higher than the norm. Based on its calculations, the average new digital subscription sold will be worth about that much over the course of the subscription. (If this seems high, it’s because the publisher in question has a higher-than-average subscription price and very good retention metrics.)

Newspaper A also generates $21.44 in total advertising per 1,000 pageviews, or $7.16 per 1,000 pageviews from programmatic advertising only. Its sell-through rates for non-programmatic ads are well below 100 percent of impressions, meaning that the programmatic number is a good proxy for total revenue from the next 1,000 pageviews they generate.

From just these few facts, we can learn a lot about the unit economics of Newspaper A’s journalism.

For example, we can tell that an article that attracts one new digital subscriber will, on average, generate as much revenue for the company as an article that generates 16,000 pageviews monetized through direct-sold advertising, or an article that generates 48,000 new pageviews monetized through programmatic advertising.

We reached that figure by taking the $345 CLV dividing it by the $21.44 and $7.16 figures in digital ad revenue per 1,000 pageviews and then multiplying each 1,000.

$345 ÷ $21.44 × 1,000 = 16,090

$345 ÷ $7.16, × 1,000 = 48,184

As a journalist or editor, knowing this fact alone could shift your perspective about what kind of coverage to focus on.

Looking at data for all articles published by Newspaper A in a particular week, the average article generated about 4,250 pageviews in the month after it was published. Using the CLV and marginal ad revenue metrics, we can therefore say that the average article generates $30.43 in programmatic ad revenue for the company.

Put another way, an article that attracts one new subscriber generates the same revenue as about 10 average-performing articles.

In contrast, the top-performing article from that time period attracted about 128,000 pageviews, or $916.48, equivalent to the revenue generated by about 2.6 subscribers.

Newspaper A cautioned that its CLV metric may be a bit inflated because its subscription system does not make it easy to gather reliable data. If we assume the more typical CLV benchmark of $217, the numbers tell a similar — if less extreme — story:

What would happen if news organizations shared and socialized this kind of information across their entire company — and, in particular, within the newsroom?

While no organization I know of has fully shared this information, my prediction is that it would help journalists do their jobs better. In today’s metrics-driven environment, the metrics actually available to journalists are primarily measures of total reach: ranked lists of articles by pageviews and in some cases more detailed data related to time spent on a page or other engagement metrics.

Even if they aren’t doing it intentionally, it would be natural for reporters and editors to respond to their successes and failures on these metrics and to adjust how they produce stories. Articles with sensational clickbait headlines get more pageviews; people producing headlines see that, and respond in kind. Stories that mention particular celebrities or politicians attract more clicks, so of course journalists are tempted to shoehorn those characters into otherwise unrelated stories. Stories covering a national or international issue generate a lot of broad interest in national media, so of course local journalists are tempted to rehash those same stories — even when there’s nothing new to add.

But we know that the coverage that attracts and retains subscribers is often different from the reporting that generates the most pageviews. Sometimes a niche topic — such as coverage of a high school sports team or highly local issue like weather — will be the sole reason for subscribing for a subset of users. More generally, users who subscribe tend to prefer reporting that is distinctive, local, and relevant to their daily lives over stories that are sensational or a rewrite of news they’ve seen elsewhere.

If newsrooms could view successful coverage not just as content that generates clicks, but also as journalism that delivers value to subscribers, it stands to reason that they would respond to those cues in the decisions they make day-to-day. (Indeed, clarifying and measuring success across the entire company is the only way I’ve seen businesses transform in the way that many news organizations must in order to survive.)

So how can publishers do this? While no publisher I know would say they’ve fully figured it out, many have experimented with versions of this approach. Here are four simple starting points based on what we’ve seen work across the industry:

These four steps just scratch the surface of what is possible with this shift in thinking. Hopefully, as data becomes more easily available and publishers become increasingly focused on digital revenue, these kinds of developments will make their way into many news organizations.

Beyond understanding the relative value of different content produced by the newsroom, having a firm grasp on these kinds of metrics can also have broader implications for how publishers look at their business models.

For example, publishers can use these metrics day-to-day as they make decisions about meter limits and other access rules. If a publication lowers its meter limit from 5 free articles per month to three, it should ask not only how many pageviews it might lose, but also what those pageviews are worth — and how many new subscriptions the change would need to generate to constitute a net positive.

More broadly, understanding these metrics can help publishers understand how they should be allocating their resources. In a recent survey for the Reuters Institute’s Journalism, Media and Technology Trends and Predictions 2019 report, three quarters of news publishers surveyed said they devoted less than 25 percent of their company’s resources to growing their subscription products, and almost 4 in 10 said the percentage of their resources devoted to subscriptions was in the single digits. If publishers were more focused on metrics like CLV, they might be inclined to shift that balance so that — at the very least — subscriptions and advertising were treated as equal goals.

Matt Skibinski is a reader revenue advisor for the Lenfest Institute.