Audiences paying for print and digital news worldwide grew very slightly in 2019, according to WAN-IFRA’s recently released 2019 World Press Trends report, with — no surprise here — that growth coming almost entirely from digital. Nonetheless, print in newspapers still dominates, accounting for 85 percent of their revenue worldwide (down from 89 percent last year).

Here are some of the findings from the report, whose authors analyzed data from companies like PwC and Chartbeat as well as from WAN-IFRA’s own annual survey of global publishers:

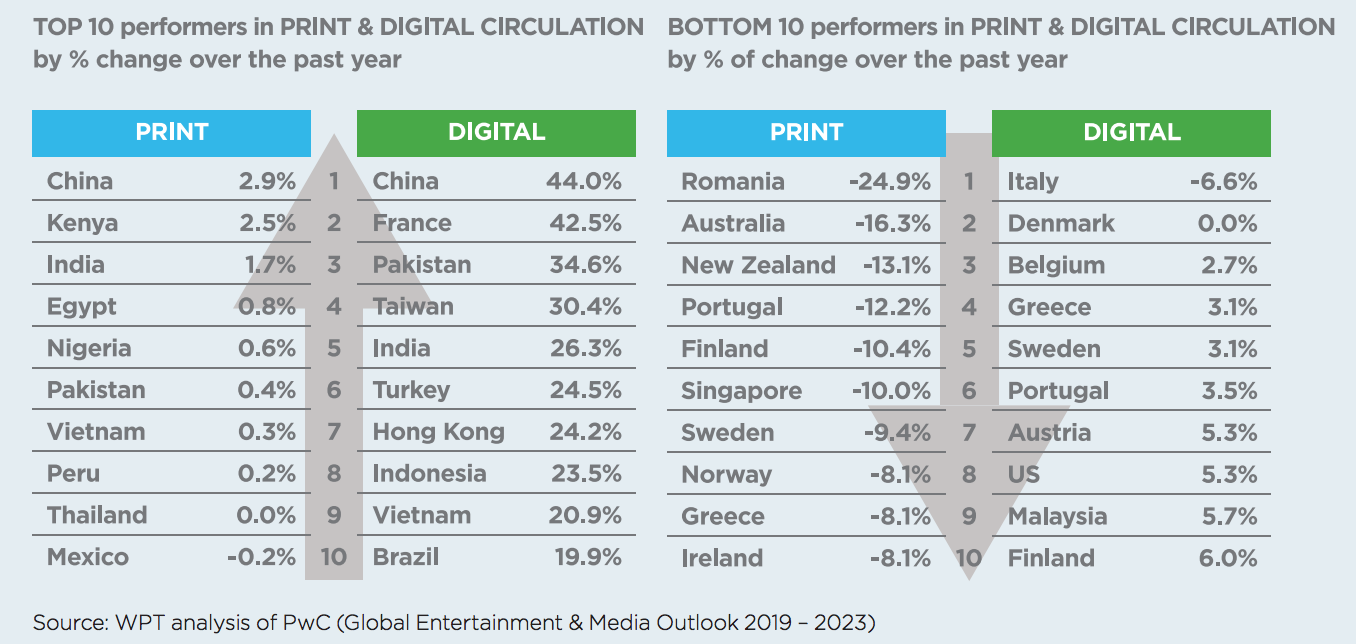

— Print circulation is still rising in some developing countries, including the world’s two largest economies, China and India. (In China, the large circulations are partly due to “compulsory subscriptions by government departments.”)

Amongst the 51 countries for which we have robust circulation data, we see a wide variation in print circulation trends over the five years from 2014 to 2018. At the positive end of the scale, newspaper circulation has mushroomed more than 15 percent in China and nearly 8 percent in India. This contrasts starkly with performances on the other end of the scale, which shows that print circulation has more than halved in Romania (down 55 percent) and Australia (down 50 percent) during the same period.

There is even a wide variation within similar markets. For example, the poorest performing newspaper (print) market amongst the European countries we track closely was Sweden, which saw print circulations drop by a third (down 31 percent) over the past five years. By comparison, in Germany, the print numbers were only down 5 percent. During that period, the total print circulation dropped 18 percent across all the tracked countries, which represent the largest markets on every continent. The median amongst the 51 countries is a decline of 17 percent.

It should be noted, however, that these figures refer to percentage change, and not absolute figures, and when you consider a country like Sweden (for example), its advanced nature of embracing digital technology and consumption behavior weigh heavily into these rankings — the same for others.

During the next year, we’re expecting newspaper audiences in China and India to continue growing at rates of around 3 percent, while further pain is expected in markets as diverse as Finland, New Zealand, Romania, and Singapore, which are all expected to see double-digit print circulation declines.

On the other hand, the number of digital news subscribers worldwide has ballooned 208 percent over the five years to 2018 and is expected to swell by a further 13 percent in 2019. The best performance is expected in France, where digital subscriptions are forecast to climb 34 percent on the back of 43 percent growth last year. On the other hand, their Italian neighbors are expected to fare the worst amongst the basket of 51 countries for which we have comprehensive data. Italian digital subscriptions actually fell by around 6.6 percent this year and are expected to drop by a further 4 percent the year ahead.

Though some of this variation may be put down to differences within the economic performances of these neighboring countries, answers are likely to be found by looking closer at both the specific structure of the markets and the innovation efforts of the publishers.

— Google remains the most important traffic source for news companies globally, WAN-IFRA says, based on its analysis of 2018 Chartbeat data: It generated for two-thirds of outside traffic in 2018, compared to Facebook’s 30 percent (and just three percent for Twitter).

Worldwide, Google provides 25 times the traffic for publishers that Twitter does and almost two and a half times that which Facebook does. Although there is wide concern about the behavior of Facebook, the advertising and e-commerce social media giant only accounts for roughly 30 percent of traffic for digital news across online platforms. Google has the highest share of digital news traffic in Africa, where it delivers almost three out of every four news visits. Its position is weakest in Asia, where it has not operated in mainland China since 2010.

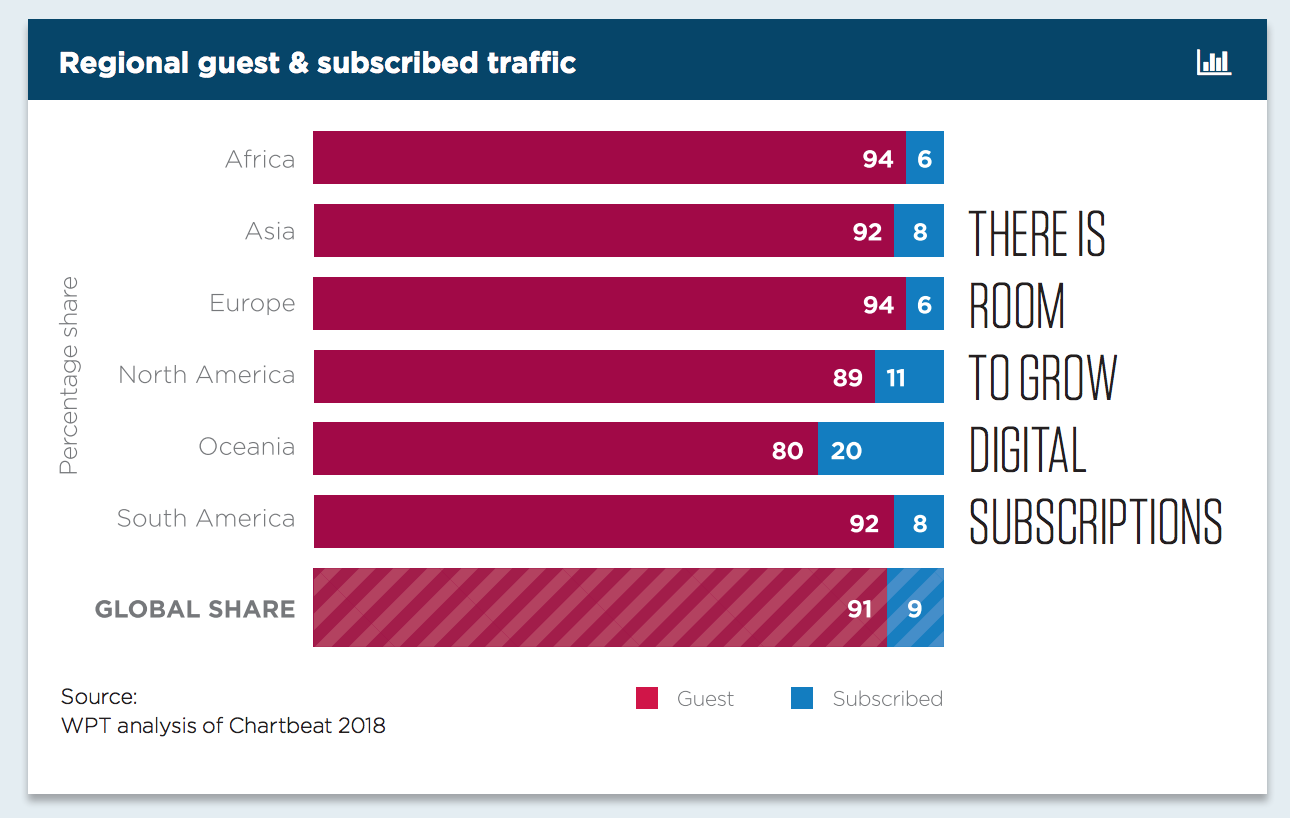

— There’s a lot of room for subscription growth:

An analysis of data from 248 countries provided by the content analytics firm Chartbeat showed that while traffic from news subscribers remained relatively stable, the number of guest pageviews has increased 76 percent over the 11 months to Feb 2019. This is a clear indication that in a world awash with misinformation, internet users globally are increasingly seeking out news from reliable publishers.

— Press freedom is in trouble.

In 1989, our records show that The New York Times was amongst 1,626 daily newspapers in the USA. By 2019, one out of every five (20 percent) had closed, leaving just 1,283 daily newspapers serving a population that had grown more than 40 percent during the same period.

But nowhere has the toll been felt more harshly than on the reporting frontline. The past decade has been the most deadly on record for journalists, according to [Reporters Without Borders]. Last year saw 84 journalists killed and 348 imprisoned. Halfway into 2019, the outlook remains grim. Already 26 people working in journalism are dead and 401 imprisoned.

This marked rise in hostility towards the press is a stark reminder of the fragility of our freedom, even in mature democracies. The pursuit of truth remains a threat to populist politicians, corrupt officials, criminal cabals and extremist groups worldwide. That is why perhaps the metrics that matter most are those we quantify for the first time this year — the role a free press plays in democracy, society, and the economy.

The full report is available free to WAN-IFRA members (or for purchase for everyone else) here.

One comment:

After checking out a number of the articles on your web page,

I really like your way of blogging. I book-marked it to my bookmark webpage list and will be checking back soon. Please check

out my web site as well and let me know your opinion.

Trackbacks:

Leave a comment