When The New York Times first launched its paywall back in 2011, it offered readers 20 free stories a month. A little over eight years later, that figure seems crazy generous — today you can read just five free Times stories a month before being asked to pay — and where the Times goes, so will other papers go: New research suggests that most newspaper publishers with successful metered pay model strategies do better with higher “stop rates,” not letting a reader sample too much before they’re asked to pay up.

When the Times added its paywall, such models were still relatively rare; today, though, they’ve become common among newspaper publishers — 76 percent of whom had one in place in 2019 — and they’ve been around for long enough that best practices are emerging. In a report released Tuesday by the Shorenstein Center and Lenfest Institute, researchers Nicco Mele, Matthew Skibinski, and Matthew Spector report some of their findings from a study of more than 500 U.S. newspapers between 2011 and 2018. A “substantial portion” of the data collected came directly from Press+, a paywall technology platform that merged with Piano Media in 2014; this anonymous data “was extracted directly from the back-end subscription system,” and only runs through 2015. The rest of the data was collected via publisher surveys “in a number of contexts, such as individual consulting engagements, industry collaborations such as the Facebook Local News Subscription Accelerator, and the Knight-Lenfest Table Stakes program.” And more than two-thirds of the newspapers studied were local, regional, or metro-area papers.Here’s some of what separates the highest-performing publishers from the rest:

— They clearly define their markets. The researchers defined market penetration as the number of unique visitors relative to the the total digital desktop audience in that market. The Minneapolis Star-Tribune came out on top “with a market penetration rate of 31 percent, nearly double the median. The Boston Globe performed second-best of the organizations studied, with a 23 percent market penetration rate.”

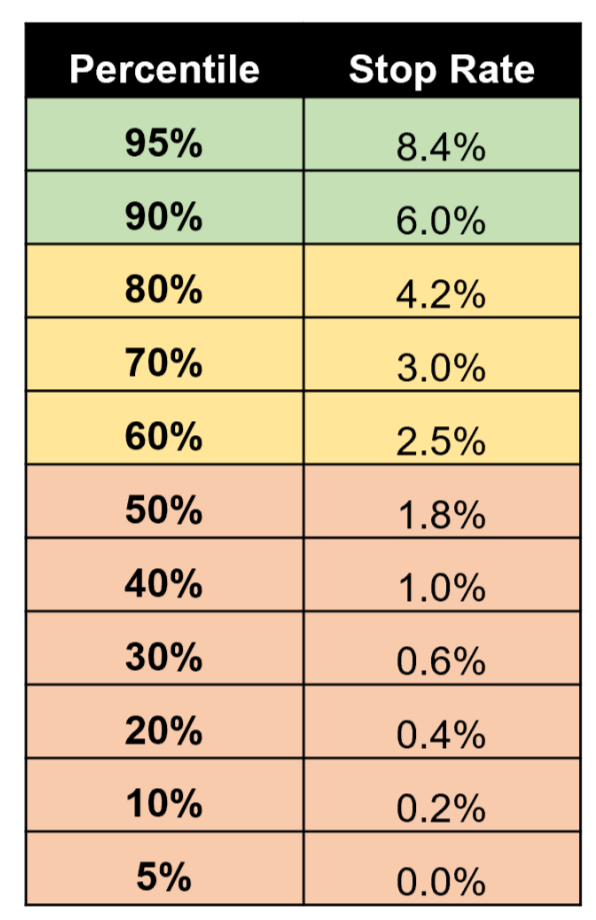

— They have high “stop rates,” i.e., “the percentage of all digital users who are ‘stopped’ by a subscription prompt, a paywall, or a meter limit. The stop rate is calculated by the number of users stopped by a meter or paywall in a given month over the number of unique visitors during that period. Most papers were stopping only a tiny fraction of readers, while the ones with stronger digital businesses were stopping significantly more:

— They have high “stop rates,” i.e., “the percentage of all digital users who are ‘stopped’ by a subscription prompt, a paywall, or a meter limit. The stop rate is calculated by the number of users stopped by a meter or paywall in a given month over the number of unique visitors during that period. Most papers were stopping only a tiny fraction of readers, while the ones with stronger digital businesses were stopping significantly more:

Among the more than 500 news organizations analyzed, the fiftieth percentile of publishers stops only 1.8 percent of their readership with a paywall or meter. Publishers with “sustainable” digital business report stop rates between the 80th and 90th percentiles of all publishers studied (at or above 4.2 percent of all readers). The publishers that reported more than 6 percent of unique visitors reaching their stop threshold had “thriving” digital subscription businesses — robust teams and well-developed audience engagement strategies…The large metropolitan daily newspapers studied report stop rates approximately double the industry as a whole, with a median stop rate of 3.64 percent.

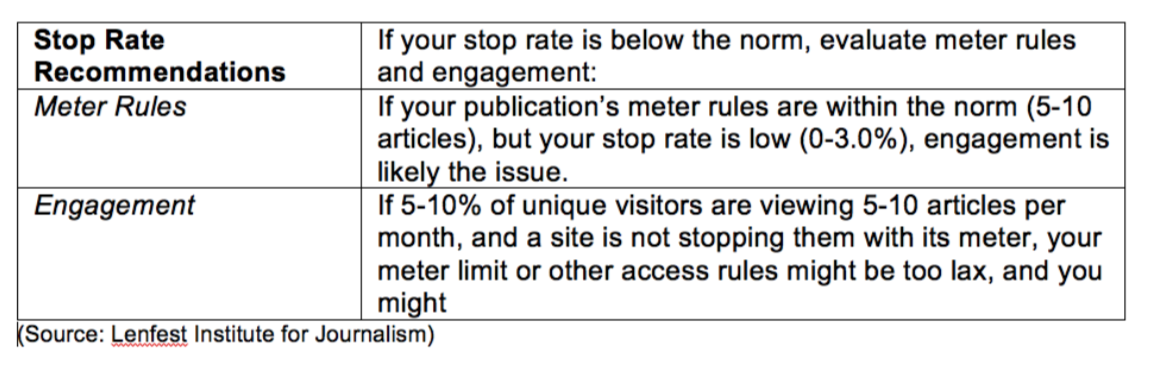

The report offers recommendations on how publishers can increase their stop rates:

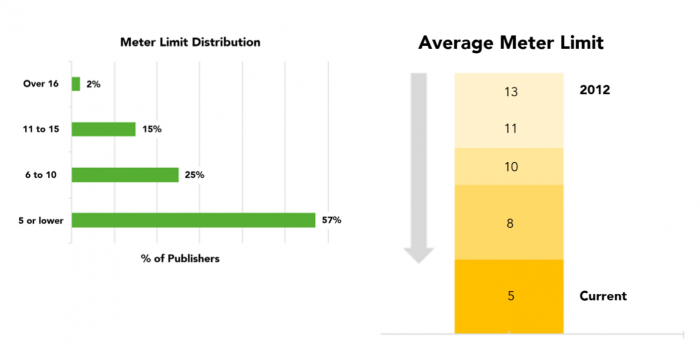

Most publishers’ paywalls have gotten tighter over time; slightly over half of the publishers studied now offer five or fewer free articles per month.

Over time, publishers have also played around with the content that they choose to exclude from the paywall. When McClatchy first introduced metered models, for instance, it offered 25 free articles per month and excluded clicks from social media and email newsletters, a policy that now seems way too generous. Today, “higher-performing publishers…tend to include nearly all article or content elements iwthin their meter, offering limited exceptions” (for content that still drives advertising revenue like obituaries, classifieds, and sponsored content).

Big papers like The Wall Street Journal are now using customized, or “bendy” paywalls (and Piano just announced a product that will make these “propensity” paywalls more accessible to smaller publishers as well).— They make checkout easy (and didn’t forget about readers on mobile). The report stresses the importance of that last step in converting a subscriber: The part where you register for an account and make a purchase.

— They understand why subscribers let their subscriptions lapse, so they can prevent it from happening. (Take heed, L.A. Times.) “High-performing publishers tended to deeply understand the source of their churn — from the reason for cancellation to the causes of payment lapses,” the researchers write. As has been found in other studies, the subscribers who keep coming back are the ones who pay and renew: “Prioritizing and sharing highlights, valued stories relevant to their content histories, and new and novel offerings with a regular cadence will help increase the likelihood a subscriber perceives the value of their ongoing relationship with your news organization.”Data from 10 major metropolitan newspapers showed that, on average, publishers saw an average 90 percent drop-off of users once they enter the subscription process along the purchase and conversion funnel. On average, only 29 percent of desktop users who saw the first step of the purchase funnel (presentation of offers and pricing choices) made it to the second step (providing their email address). Only 14.8 percent reached the step of the process at which they were asked to enter payment information, and 9.9 percent reached the confirmation page indicating that they had completed their purchase.

Across the publishers studied, the differences in success rate were critical: more than 90 percent of users dropped out between the first step of the purchase process and the last. This drop-off was even higher on mobile devices; the desktop conversion rate was five times higher than the rate for mobile.

You can read the full report here.