For anyone who can remember being floored by the mid-1980s Chrysler sedan that warned “your door is ajar” in delightful monotone, it’s still kind of thrilling that Cadillacs come with wifi these days. But for a growing number of Americans, it’s hard to imagine going anywhere without an iPhone in one pocket and an iPad within arm’s reach.

Here it is, as if there was any doubt: The age of mobile.

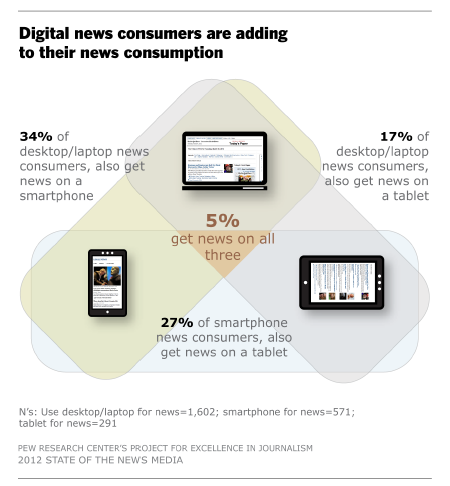

One in four American adults now has a smartphone, and one in five owns a tablet. And 27 percent of Americans are getting news on mobile devices — increasingly across different platforms. That’s according to the Pew Research Center’s Project for Excellence in Journalism, and its annual report on the State of the News Media in 2012, released today.

One takeaway from Pew’s January 2012 survey of more than 3,000 adults is that our increasingly mobile reality brings new opportunities and, yes, more uncertainty for journalism.

Pew finds mobile devices are driving up news consumption, immersing audiences in content and strengthening traditional long-form journalism. But the industry is still following the lead of tech giants when it comes to the ways in which news is becoming more pervasive, which begs arguably the biggest of the big questions that Pew’s buffet of data raises: Who stands to benefit economically from the mobile shift?

“If they want to be everything, news is part of that, and people are spending more time with news.”

“When you look at the revenue side, we see even more that the tech companies are strengthening their hold on the revenue side, on who’s gaining the profits from this era of news,” the project’s deputy director, Amy S. Mitchell, told me. “While there may be some positive side in terms of what consumers are doing, the big technology companies are taking an even bigger piece of the revenue pie.”

Illustrating that point: Last year, five technology giants — not including Apple and Amazon — generated 68 percent of all digital ad revenue. By 2015, Facebook is expected to account for one of every five digital display ads sold. In contrast, print ad revenues were down $2.1 billion, or 9.2 percent, last year. Losses in print outweighed $207 million in online advertising gains by a ratio of 10 to 1.

This dynamic gave Pew researchers an idea that has been floated before: Could a tech giant like Google or Facebook swoop in and “save” a household-name newspaper by buying it? Mitchell says there are signs that “speak to the possibility of that happening,” namely the idea that technology leaders might identify news production as a path to omnipresence in consumers’ lives. But why would a profitable company want to acquire an operation — even one with a legacy brand — that’s in the red?

“The technology giants — the big technology companies — have all taken steps in the last year to kind of be an ‘everything,'” Mitchell says. “To not just be the king of search but to also have social networking, to have a video component, to also have your email as well as your social networking, as well as your news feed. While news may not be the revenue generator that these companies are looking to own, it is a part of how people are spending their day. If they want to be everything, news is part of that, and people are spending more time with news.”

Some of the other interesting tidbits in the report:

• Some rural Native American and Alaska Native populations are adapting straight from print to mobile, skipping right over desktops and laptops. It’s a pattern similar to what’s happening in parts of the developing world.

• Some 133 million Americans — 54 percent of the online U.S. population — are active on Facebook, and they’re spending about seven hours per month on the site. That’s 14 times as long as the average person spent on the most popular news sites. Just nine percent of adults in the United State say they regularly follow Facebook or Twitter links to news stories — despite the social media efforts of news organizations.

• Social media platforms “grew substantially” in 2011, but people are still more likely to use search engines or go directly to a news site than follow links from social media.

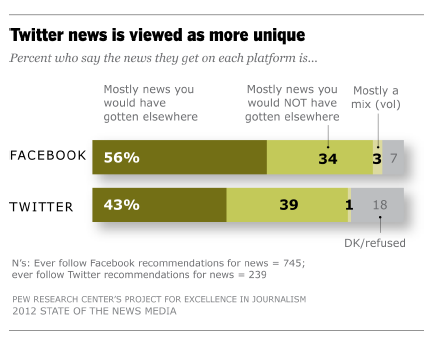

• Consumers perceive Twitter as having more news that’s harder to find elsewhere than Facebook. But most of those surveyed say they believe the news they get on Facebook and Twitter is news that they would have seen elsewhere without those sites.

• Print newspapers “stood out for their continued decline, which nearly matched the previous year’s 5 percent drop.” The latest Pew numbers show that total newspaper revenue — that means subscription as well as ad revenue — has dropped 43 percent since 2000. Over the last five years, an average of 15 newspapers (about 1 percent of the industry) has disappeared each year.

• As many as 100 newspapers are expected to put up paywalls (in some form) in the coming months. They would join the roughly 150 dailies that have already shifted to “some kind of digital subscription model,” which means slightly more than one-tenth of surviving U.S. dailies have a paywall or subscription service of some kind.

• More consumers are worried about their online privacy, which creates “conflicting pressure” for news organizations that need revenue to survive while also maintaining their audience’s trust. A separate Pew study found two-thirds of Internet users were uneasy with search engines tracking their activity, but they’re also relying more heavily on the services that such companies provide.