The news world already has produced enough news for a whole year in the first half of 2013. What lies ahead for the second half of the year? We’ve got all kinds of clear trend lines, large and small, and can pick out three overarching phenomena:

Within those storylines, we’ve got a lot to watch for into 2014. Here’s the top of my list. Which of these stories (as the newly reemployed Keith Olbermann would say) will you be talking about in the next several months?

We thought that five of the 40 largest newspapers in the U.S. would be sold; now Tribune is just spinning them off. We thought there might be a half dozen bidders for The Boston Globe. Now there are apparently only three with bottom-of-the-range, sub-$100 million bidding. After low prices paid in Tampa, San Diego, and Philly, it’s clearer still that metro newspapers are distressed assets. Better, as Tribune has now done, to push them away from the mothership so they don’t drag down the financial value of a larger, diversified company. Broadcast isn’t a great business — its recent consolidation push is further evidence of that, as cost savings in a maturing industry becomes more important than revenue growth — but compared to newspapers, it’s a much better play. That seemed to be the case a year or two ago; the first half of 2013 has affirmed that. In brief, it’s tougher and tougher to make the argument that newspapers are creatures of the marketplace.

Unlike the Media General/Berkshire Hathaway Media and New York Times Co./Halifax Media Group sales, which included the real estate under the papers’ operations, Tribune Company’s split subdivides its to-be-spun-off newspapers. The fact that Tribune was holding on to all the real estate — office and production facilities — was lightly noted in the Tribune spinoff announcement. Most substantially, that move deducts at least a third of the financial value of the newspaper brands, and, in some cases, as much as half. Now Tribune has hired a president of real estate to maximize the value of what it describes as its “seven million square feet of real estate,” which probably includes all the terra firma today under its newspaper, broadcast, and other companies. It’s an intriguing play: Recent buyers have often highly valued the hard asset value of real estate in recent transactions. In addition, numerous newspapers have sold their iconic downtown office buildings, moving out to lower-cost burbs. It’s time to harvest financial value wherever you can, and we’ll see more of it in the next several years.

The U.S. newspaper industry found itself 2 percent down in revenue for 2012, as circulation revenue grew 5 percent year over year. The big 2013 aspiration: getting to zero growth. At the current rate, that aspiration will go largely unmet by the larger dailies. The reason: Print ad loss is accelerating. It seemed that the Great Recession accelerated the shift in ad dollars moving to digital; now it looks like the Mild Recovery is doing the same. Expect print ad losses to parallel last year’s, approaching 9 percent. Of course, even when the percentages remain the same, each year they slice off a smaller and smaller base. Circulation revenue gain plus tepid digital ad growth can’t match that 9 percent, so expect again a year of year-over-year revenue decline. That’s been the case since 2006. The bottom line is this: The only way to maintain profitability as revenues continue to drop is to cut expenses, staff, days of printing, or anything deemed least essential.

Take a lesson from the news industry’s cousins, movies and TV. There we see Amazon, Netflix, and now Hulu each investing hundreds of millions of dollars in acquiring and producing content. Their monthly all-access pitch to customers depends on two kinds of content: unique and more. So Netflix’s “Orange is the New Black,” debuting this week, is one more step on that path. Upstart media like Atlantic Media (which launched Defense One this week), BuzzFeed, and HuffPost have followed, more modestly, in those footsteps. So has Bloomberg in its various pushes. Among newspapers and magazines, the investments are few and far between, with the globals (WSJ, NYT, FT) doing small targeted plays. Most regional dailies are still in stable or cutback mode, given deteriorating advertising.

For many, the conundrum of producing more content with less means more basic restructuring. “This year will continue the leaning out of the troops,” says Laura Hollingsworth, a Gannett veteran who was recently appointed publisher in Nashville. “How do you really continue to prioritize what readers need/want most, along with managing all the different platforms, with much less of a team? [We’re talking about] managing UGC [user-generated content], key franchise and passion topics selection and honing our content output in for even further reductions and prioritization. Can we think about new models that shift our thinking from ‘content providers’ to ‘service providers,’ surrounding content and lots of other things to help people live and know better in their local areas?”

Then there is the contrarian Orange Country Register, the company that believes that more content produced by more journalists is the ticket to better business future. As editor Ken Brusic, who’s ridden through deep cuts and now restaffing, recently said plainly at ASNE, “Less is less.” (Video worth sharing).

Hands down, marketing services is the go-to new play of most newspaper chains. They believe that selling digital services to small- and medium-sized businesses will be the new vital revenue source they need. In a recent report I wrote for Outsell, I estimated that digital services revenue could equal a tenth of ad revenue for daily newspapers within three years, to a total of $1.8 billion. Hearst’s LocalEdge platform continues to supply a lot of the industry. One of its earliest takers has been the Star Tribune. For chief revenue officer Jeff Griffing, it has been learning on the fly and, among other tactics, deciding whether to focus on existing Star Tribune customers or new business.

“Marketing services opportunity remains bigger than ever, although tougher than ever; even with the depth of competition in our market, there’s a significant untapped client base we have and continue to growth through new business development,” he says. “Now that we’ve had some time to build the Radius brand and get into the market, our near-term opportunity is to leveraging existing client relationships.”

It’s not large metros that believe in the strategy. Morris Communications, operators of smaller dailies, believes it’s a keeper as well, and it gets going after many non-ad customers as well. It set up a separate company, Main Street Digital (MSD), as a “pure-digital sales company.”

“This is the way we’re doing the digital services thing,” says Steve Gray, who heads Morris innovation efforts. “Operating in seven of our markets, the MSD teams use a completely different sales model from the legacy sales teams, based on calling on every business in the market with pure hunters and handing the business off to customer service managers. The KPIs and SOPs are like nothing our legacy sales teams have ever seen before.”

The Star Tribune’s Griffing points to marketing services’ twin: content marketing. The Star Tribune’s May-launched family health site, sponsored by Children’s Hospital, is prototypical of a revenue stream he believes may widen. “The benefit of content marketing and how it’s evolved is Star Tribune is engaging in more, meaningful, collaborative conversations with major local/regional advertisers, and moving the discussions beyond basic ad units. As a sales organization our conversations/value/deals become bigger. We’re in early stages here; this will be a major strategic contributor to growth this year and beyond.”

Then there’s the Orange County Register’s expanding strategy. In addition to its big push home county push, it is now poking into neighboring L.A. County, in Long Beach. The once-Knight Ridder-owned Press-Telegram is barely a shadow of its heyday self, and the Register believes a locally focused 16-page daily tab can win new ground with readers and advertisers. We haven’t seen too many recent forays into adjacent markets, so this one’s worth watching in the turbulent L.A. market. Then, there’s the competitive push of the New Orleans Advocate — a sign that what seems like daily retreat (that of Advance’s Times-Picayune) proves tempting to new entrants.

Meredith Publishing is taking another tack, adding a print edition (and a TV show) of the digital-only AllRecipes.com that it bought last year. Big reminder: Multi-platform publishing means strong print as well.

So far, there are no announced or unannounced takers. Privately, peer publishers are confounded by the strategy, as they understand it. Even Digital First Media, whose CEO John Paton is the most sympathetic to the strategy, says that despite rumors, he has no plans to skinny home delivery in the L.A. market. DFM’s Oneida (N.Y.) Daily Dispatch has gone to three days a week, and several smaller California DFM dailies have dropped Mondays. Look for more papers to drop more days of print and/or home delivery, but over the next several years. The key here: how much more seven-day print subscribers are willing to pay home delivery.

That’s really the key here. As John Murray, VP/audience for the Newspaper Association of America, points out, the Advance strategy and the higher priced all-access subscription movement are really two sides of the same coin. Both strategies recognize that print is in rapid decline — and will go away at some point. The more than 450 North American dailies that have embraced all-access (print + digital) (“The newsonomics of Why Paywalls Now”) pricing are basically saying: If they want seven-day print home-delivered, make ’em pay. They’ve priced up subscriptions anywhere from 10 to 100 percent. You want the skinny, almost ad-free Monday paper? Pay more than a dollar a day for it. At some point, enough seven-day subscribers will tire of paying extra for print, as they transition to digital, and that’s when we’ll see seven-day print get its own Newseum space. The Advance thinking: With print audiences and advertisers eroding quickly, don’t spend effort and focus on propping up the fading business — get on, full-throttle, with digital. Day-dropping may be all about timing — though timing in years more than months. But in this time of great news transformation, timing counts, and will divide the winners from the losers.

Cast adrift — but with a handy $2.6 billion in cash and no debt, making its peers oh-so-envi0us — the world’s largest newspaper company is in the midst of furious change. At the flagship Dow Jones/Wall Street Journal, it’s tough to find anyone in management who’s doing the same thing they were a couple of years ago. That kind of change is unsettling, and means the company will take a while to find a new footing, under both new News Corp CEO Robert Thomson and Dow Jones CEO Lex Fenwick’s accelerating Bloombergization of Dow Jones. Fenwick’s push is a big bet and a tough one, given how relatively small the company (news + data) is compared to competitors Bloomberg and Thomson Reuters. The Journal itself offers the greatest growth potential — largely global — for the new News Corp. We’ll begin to see the standalone energy of the new company this fall when it makes its first quarterly financial report. Those financials had been obscured in the old, larger News Corp.’s reports. We know that the new entertainment-oriented 21st Century Fox will rise and fall on the popularity of its film releases, its Fox TV strengths, and the challenges of its cable and satellite businesses. The new News Corp is left to share the multiple pressures of the limping newspaper industry, challenges it pursues on three continents:

Add it up, and Robert Thomson’s digital-oriented remaking of the company is one of the toughest jobs in publishing.

Americans pay little attention to the long-running set of British scandals, as News Corp’s Hackgate rolls through the courts and the BBC’s scandals multiply without end, Jimmy Savile’s molestation run, NewsNight blunder,s and BBC management platinum parachutes, among them. (All of which have helped give Guardian an audience growth run and progress on digital revenue.) The scandals have forced New York Times Co. CEO Mark Thompson, the former BBC chief, to cross the pond much more often than anticipated when he assumed his new job in November. NYT Co. felt compelled last week to reiterate his support: “Mark [Thompson] continues to have the full support of the New York Times Company board and of his colleagues in management.” Though he is credited internally with speeding up the pace of change at the Times, any disruption in focus can’t help as the Times’ 2013 has been choppier than expected. New numbers come out Aug. 1 for the second quarter. Into this perilous second half of the year steps new ad chief — filling the spot of long-time ad director Denise Warren, who continues to head up digital — Meredith Levien, hired away from Forbes.

It’s incredible, really. About a third of newspaper site traffic now comes from mobile, up from about 25 percent last year and headed toward 50 percent by 2016. Yet, mobile generates little in direct revenue. Yes, it’s a big part of the all-access subscription offer, but in general it’s more of a problem than a solution for publishers. Raju Narisetti, now deputy head of strategy for the new News Corp, cites one key reason: data is harder to gather on mobile than on the web, limiting effective targeting. Add to that the small size of smartphone screens and lack of ad positions in tablet products, and many publishers see less than 5 percent of their overall digital revenue coming from mobile — even as it accounts for a third of traffic. It’s akin to the problem on traffic from outside the U.S.; it pumps up traffic numbers, but bears little relationship to making money. Of course, it’s now Google and Facebook that are beginning to solve the mobile ad future, forcing publishers to play a familiar game: catch-up.

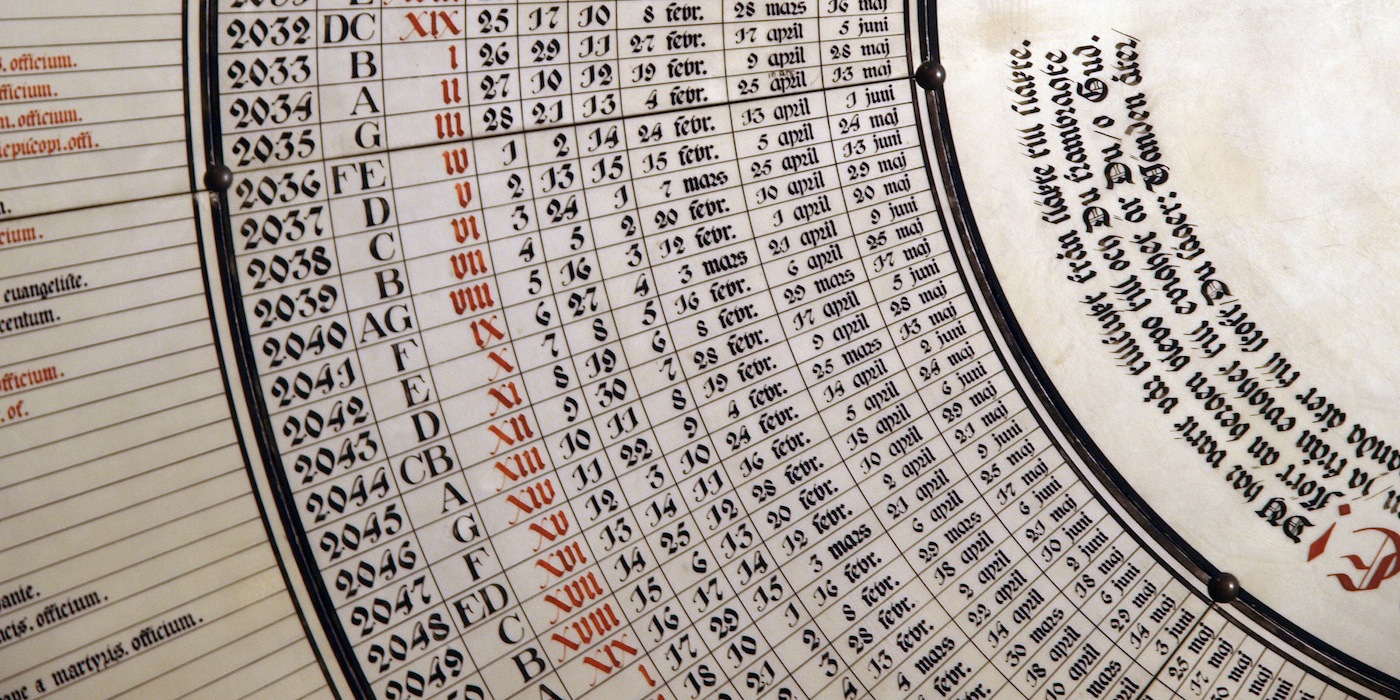

Photo of Horologium mirabile Lundense in Lund Cathedral by mararie used under a Creative Commons license.